EY

EY is a global leader in assurance, tax, transactions and advisory services. Our 175,000 people are united by our shared values, which inspire our people worldwide and guide them to do the right thing, and our commitment to quality, which is embedded in who we are and everything we do.

EY has sponsored:

-

Where PE is going in health care

Three experts discuss how private equity is capitalizing on healthcare’s move to “value-based” care.

January 26, 2018More -

Value-based care & PE: where are we now?

Three experts discuss the future of value-based healthcare and other changes that could rapidly impact the investment landscape.

January 12, 2018More -

What’s wrong with U.S. health care

Three experts discuss the challenges facing the U.S. healthcare system, and what that means for investors.

December 15, 2017More -

How technology is lowering the costs of diabetes

Smart phones are enabling pre-emptive care and lowering the costs of many diseases.

November 10, 2017More -

The Rising Deepwater Opportunity

Why you should be bullish about the deepwater oil and gas investment opportunity.

November 6, 2017More -

Marketing to patients can lower costs

Marketing healthcare services is more about controlling costs than promoting services.

October 27, 2017More -

Lower costs, improve outcomes

Why private equity is focused on home care and urgent care clinics.

October 16, 2017More -

EY’s health care practice

The U.S. Health Sector Leader of EY, discusses the firm’s practices in the healthcare sector.

October 16, 2017More -

3 priorities for PE investors in value-based care

EY’s U.S. Health Deputy Leader discusses best practices for PE investing in value-based care.

October 16, 2017More -

Private Equity Value Creation: Sales Team Optimization

How investors can help their portfolio companies add value through sales-platform optimization.

September 29, 2017More -

Private Equity Value Creation: Unleashing Advanced Analytics

Expert insights from Arsenal, Sentinel and EY on value add strategies in the portfolio through data analytics.

September 15, 2017More -

Private Equity Value Creation: Digital Transformations

Expert insights from Arsenal, Sentinel and EY on digital value add strategies in the portfolio.

August 28, 2017More -

On-Demand Webinar: Inside the Energy Tech Revolution

Experts discuss the current state of energy technology, and its impact on human capital.

March 23, 2017More -

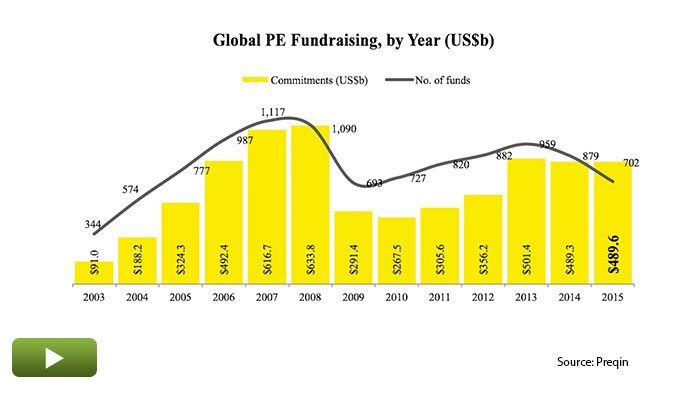

Private Equity in 2016 – Fundraising

A brief overview of the 2016 private equity fundraising market

March 3, 2017More -

What Dealmakers Are Thinking in 2017

An overview of deal flow in 2017, including thoughts on why IPOs may be back in favor as an exit option.

February 24, 2017More -

Private Equity in 2016 – Emerging Markets

The top trends in emerging markets private equity, with expert commentary from EY and Actis.

January 22, 2017More -

Private Equity in 2016 – Exits & IPOs

A brief overview of the private equity exit and IPO market in 2016 by Peter Witte of EY.

January 22, 2017More -

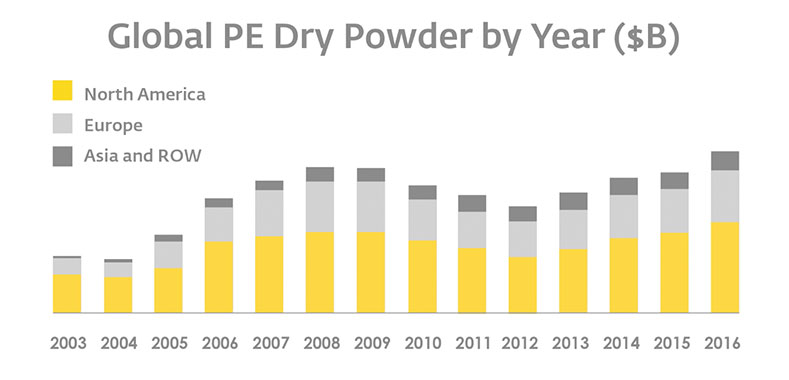

Private Equity in 2016 – Dry Powder

A brief overview of the growth of private equity “dry powder” in 2016. Featuring experts from EY and Preqin.

January 22, 2017More -

Private Equity in 2016 – Acquisitions

A brief overview of the 2016 private equity deals market.

January 13, 2017More -

ESG ‘Pays For Itself’

Alex Krueger of First Reserve discusses the importance of ESG in energy investing.

December 27, 2016More -

How ESG Drives Company Performance

How can private equity firms realize real improvements in their portfolio companies via ESG?

December 9, 2016More -

Advent Remains Bullish on Latin America

The head of Advent International’s Latin America investment platform discusses the outlook for his firm in the region.

November 25, 2016More -

Advent: Back in Argentina

Why a major private equity firm has returned to a country long shunned by the asset class.

November 25, 2016More -

Why a Rise in Energy Bankruptcies is Good for PE

Private equity has an advantage when looking for good values in energy assets during a down market.

October 14, 2016More -

Why Timing is Everything in Today’s Energy Market

As low oil and gas prices persist, knowledgeable private equity firms can take advantage of the situation and buy assets from energy companies in need of a lifeline.

October 14, 2016More -

What ESG Needs to Get Investors’ Attention

How ‘materiality’ and investor sophistication are helping establish ESG in private equity.

July 17, 2016More -

The Current State of Colombian PE

Hector Cateriano and Patricio D’Apice of MAS Equity Partners reveal where to find opportunity in today’s Colombian private equity market.

July 10, 2016More -

ESG: How to Report, How to Mitigate Risk

ESG in private equity is evolving on two important fronts – reporting and risk mitigation.

July 10, 2016More -

Two Great Sectors in a Troubled Brazil

Jaime Cardoso of Bozano Investimentos talks about the trends driving education and healthcare investing in a struggling Brazilian economy.

July 4, 2016More -

Hard Evidence of ESG Value Creation

Three ESG experts share stories of how ESG initiatives drove profits in private equity investments.

June 26, 2016More -

IFC AMC’s Take on Emerging Markets and Infrastructure

Gavin Wilson of the IFC Asset Management Company discusses current opportunities and challenges in the emerging markets, and why the infrastructure play is particularly compelling.

June 7, 2016More -

PE in the Emerging Markets: Unevenly Challenged

Key trends in emerging markets private equity in 2015.

January 18, 2016More -

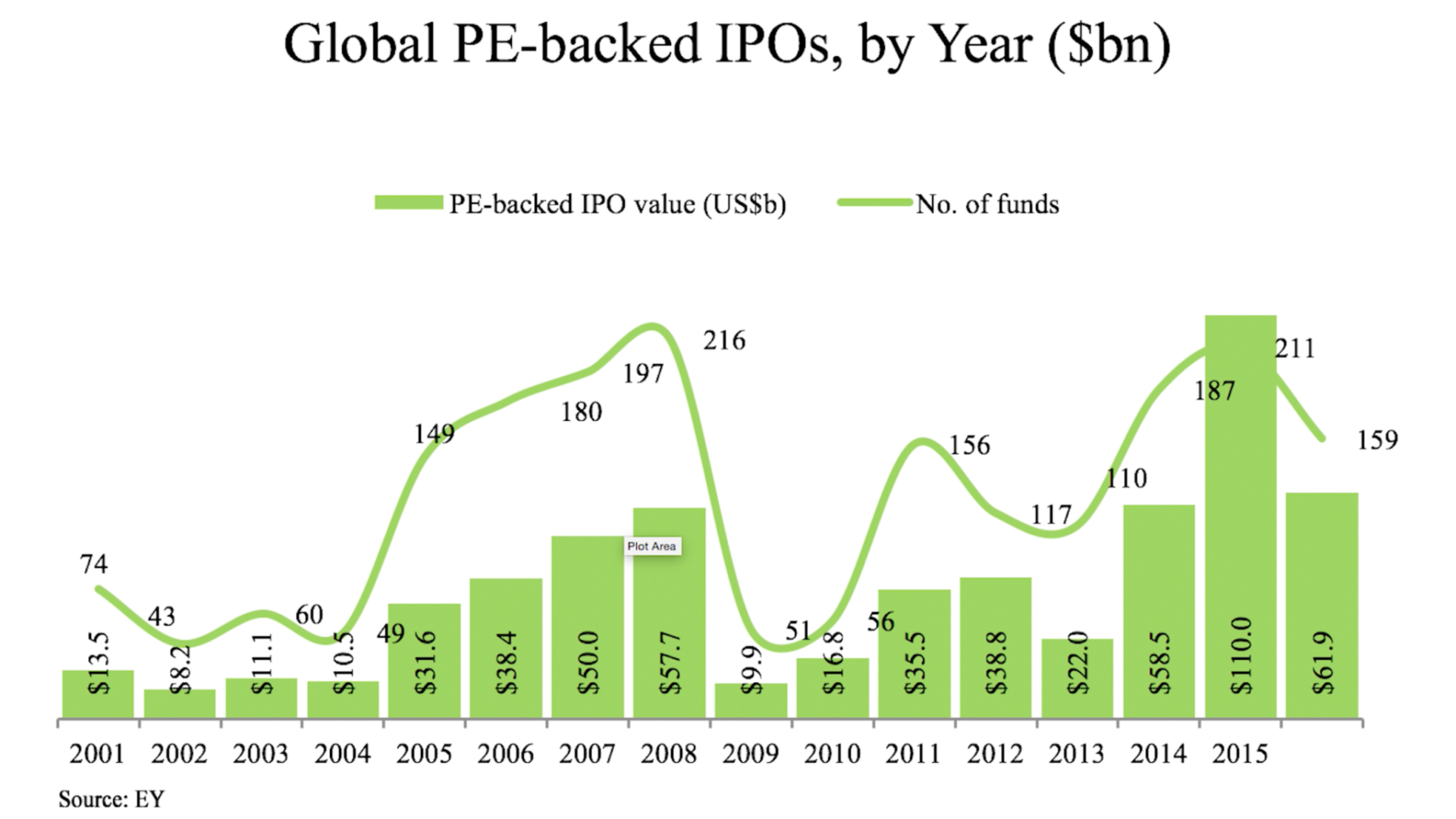

PE-Backed IPOs: Down but Not Out

Key trends in market for private equity-backed IPOs in 2015.

January 13, 2016More -

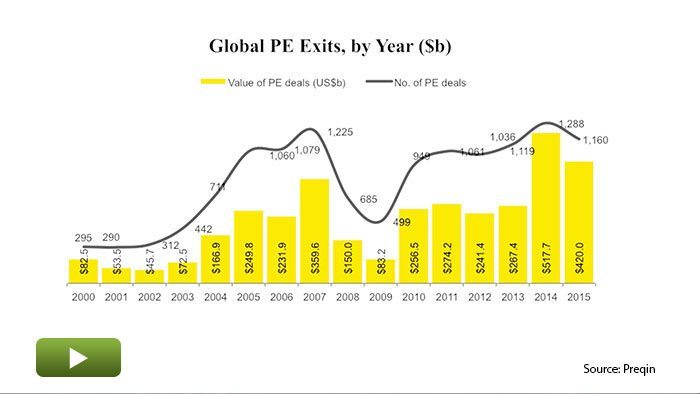

PE Exits: Robust, but Good Enough?

Key trends and drivers of the private equity exit market in 2015.

January 4, 2016More -

PE Deal Activity: Healthy But Outpaced by Corporate Buying

Key trends and drivers of the private equity deal market in 2015.

December 28, 2015More -

Fundraising: Distributions Drive Another Strong Year

Key trends and drivers of the fundraising market in 2015.

December 21, 2015More -

Unique Qualities of LatAm Countries

Experts from EY, Victoria Capital and Harbourvest Partners explain how Latin American countries present different investment opportunities for PE than other emerging markets.

November 30, 2015More -

Expert Q&A: With Michael Rogers of EY

Michael Rogers of EY says Brazil’s economy will eventually make a comeback, making Latin America an attractive play for PE investors.

November 30, 2015More -

Who Will Survive the Oil & Gas Shakeout?

An oil and gas expert from EY explains how he is assessing the potential winners and losers in a market shakeout.

November 23, 2015More -

How PE Firms Can Adapt in LatAm Downturn

Private equity firms should adjust their playbooks when dealing with Latin American companies in the current economic downturn, say experts from EY, Victoria Capital, and Harbourvest Partners.

November 9, 2015More -

What Victoria Capital Saw in Colombia’s Corona

Victoria Capital’s Carlos Garcia discusses the firm’s investment in Corona, a building materials company based in Colombia.

October 26, 2015More -

Staying Optimistic About LatAm Opportunities

Experts from EY, Victoria Capital and Harbourvest Partners discuss current Latin American opportunities for private equity investment.

October 26, 2015More -

ADIA’s Kester on a Career Building Portfolios

James Kester discusses portfolio construction and what he learned from a career working at some of the largest LP organizations.

October 26, 2015More -

Former ADIA Chief: Sovereign Wealth Funds and the Future of PE

The former head of PE at Abu Dhabi Investment Authority, James Kester discusses the rise of sovereign wealth funds.

September 3, 2015More -

India’s PE Market Rising Above Missteps

Sunish Sharma of Kedaara Capital Advisors outlines missteps in India, the subsectors where he sees investment opportunity in India, and what areas companies based in the country are sometimes lacking.

August 10, 2015More -

Global PE’s “Cyclical Chance to Buy” in Energy

EY’s Andy Brogan on the global impact of commodity price volatility on PE deals, what energy sectors are still attractive, and the advantages of PE in the current cycle.

July 13, 2015More -

Indonesia’s Value Proposition

Experts from FLAG Capital Management, Headland Capital Partners, and EY say Indonesia is an attractive opportunity.

July 6, 2015More -

Locating the Right Southeast Asia Deals

EY’s Mike Rogers, Headland Capital Partners’ Paul Kang, and FLAG’s Wen Tan discuss the culture of business deals in Southeast Asia.

June 15, 2015More -

PE Opportunity Abundant In Southeast Asia

EY’s Mike Rogers, FLAG Capital Management’s Wen Tan, and Headland Capital Partners’ Paul Kang discuss investment obstacles and opportunities in Southeast Asia.

June 1, 2015More -

A Turkish Supermarket Delivers Super Returns

BC Partners’ Nikos Stathopoulos gives an overview his firm’s successful investment in Turkish supermarket chain Migros.

May 11, 2015More -

Seeing Value in Infection Prevention

Baird Capital’s Mike Liang discusses the appeal of investing in a company that makes products aimed at preventing hospital-acquired infections.

May 11, 2015More -

Identifying Value-Creation Categories

Private equity managers are increasingly focused on value creation to help offset the high prices in today’s competitive economic cycle, says EY’s Michael Rogers.

May 11, 2015More -

Benefits of a Robust ESG Strategy

Many private equity firms are seeing a correlation between a robust ESG strategy and a higher IRR, says Michael Rogers of EY.

April 27, 2015More -

Lending, Spreads and “Extreme” Interest Rates

Christopher Flowers share his views on investing in the lending business.

April 27, 2015More -

“Positive Territory” for PE in Europe

Nikos Stathopoulos of pan-European PE firm BC Partners explains the set of opportunities across the continent.

April 6, 2015More -

Why PE Shouldn’t Ignore the Caribbean

Portland Private Equity’s Michael Lee-Chin explains why the PE firm saw opportunity in companies in the Caribbean—a region often ignored by the asset class.

April 6, 2015More -

How the ACA is Changing Healthcare Investing

A longtime healthcare investor describes the vast changes to the market as a result of the Affordable Care Act.

April 6, 2015More -

Why Z Capital Acquired MSDP

Z Capital’s Jim Zenni details the firm’s acquisitions of performance automotive-parts makers MSDP Group and ACCEL and explains its interest in the sector.

March 30, 2015More -

How PE Can Benefit from Oil-Price Volatility

Deborah Byers of EY explains why oil price volatility is the norm, what players in each subsector are ripe for M&A, and what will drive the rise in oil prices.

March 16, 2015More -

Z Capital’s Unique Approach to Deal Sourcing

Z Capital Partners’ Jim Zenni tells Privcap about the firm’s proprietary deal sourcing system and explains its focus on companies with operational and financial issues.

February 2, 2015More -

How GTCR’s Leadership Strategy Built Devicor

GTCR’s Dean Mihas tells Privcap about his firm’s exit of medical-devices business Devicor and how “The Leadership Strategy” was used to build the portfolio company.

January 19, 2015More -

Energy Opportunities in Latin America

Three experts on the Pacific Alliance trade bloc discuss the opportunities for private equity investment in member countries’ energy sectors.

January 5, 2015More -

The Evolution of Mexican And Colombian PE

Experts on the Colombian and Mexican private equity space describe their markets’ evolution and the outlook for Latin American PE as the market matures.

December 29, 2014More -

-

Inside Carlyle’s Middle-Market Group

The Carlyle Group’s Rodney Cohen tells Privcap how the firm’s sub-group for middle-market investments operates, and how they source and win deals.

December 15, 2014More -

Building Value in the Pacific Alliance

Three private equity professionals engaged in the Pacific Alliance trade bloc discuss the best way to build value in a portfolio company.

December 1, 2014More -

The Macro Impact of the Pacific Alliance

The Pacific Alliance trade bloc is giving its member countries greater bargaining power on the world stage and opportunities to engage with their neighbors, says an expert panel.

November 3, 2014More -

Private Equity in China

In this free 45-minute, in-depth conversation, you will hear from seasoned experts about the state of China’s huge but rapidly changing private equity opportunity.

August 15, 2014More -

Deal Story: Profiting from a Bad Loan in China

How an investment in a troubled Chinese loan became a winning deal for Shoreline Capital.

August 13, 2014More -

Chinese GPs Eye Credit Strategies

Why so many Chinese GPs are now looking at expanding into credit strategies.

August 13, 2014More -

Credit, Distress and NPLs in China

China private capital experts discuss the rise of shadow banking and the sale of NPLs.

July 16, 2014More -

Expert Q&A with Robert Partridge of EY

A conversation about EY’s services for private equity firms investing in China.

June 25, 2014More -

China’s IPO-Challenged Private Equity Market

Three veterans of the Chinese private equity market discuss the current state of play.

June 25, 2014More -

Deal Success & Family-Owned Businesses in Colombia

A successful exit of a Colombian healthcare company; why doing deals with families can be challenging.

May 12, 2014More -

Webinar Replay: PE and the Energy Opportunity

An expert overview of the revolutionary changes to the North American energy landscape and what this means for private equity investors and institutional capital.

May 8, 2014More -

Energy, Healthcare and the Colombian Opportunity

Important trends in the Colombian energy and healthcare markets are spelling opportunity for private equity firms.

April 28, 2014More -

Expert Q&A with Eva Garcia de la Fuente of EY

An expert conversation about EY’s services to private equity investors in Colombia.

April 15, 2014More -

Colombia’s “Incredible Transformation”

Experts from Advent International, Tribeca Asset Management, and EY describe a blossoming private equity landscape in Colombia.

April 15, 2014More -

African Private Equity Roundup 2013

Private equity deal and fundraising activity in Africa doubled during 2013, explains Michael Rogers of EY.

February 28, 2014More -

Devices of Value: Baird Capital Backs Insightra Medical

Baird Capital’s Mike Liang describes his firm’s investment in Insightra Medical.

February 26, 2014More -

Managing Music: KKR’s Investment in BMG

Philipp Freise of KKR shares details about the highly successful investment in music-rights management business BMG.

February 5, 2014More -

Broadband Reboot: How New Silk Route Improved Augere

New Silk Route’s Parag Saxena discusses telecommunications company Augere’s shift in operational model.

February 5, 2014More -

Stories of Impact Success

From an education company in Brazil to a timberland deal in Africa, private equity deals have shown the ability to make money while also transforming lives.

January 22, 2014More -

Stories of Growth and Impact

Stories of how investments and business initiatives in the emerging markets have had societal impact.

January 22, 2014More -

Women, Private Equity and Career-Building: Free Webinar

Free webinar playback featuring candid insights from private equity market veterans.

January 17, 2014More -

How Entrepreneurs and Capital Drive Impact

The important role of entrepreneurs in the development of society in emerging markets.

January 13, 2014More -

Latin American PE Success Stories

Stories of value creation: a Brazilian eyewear chain, a Peruvian restaurant group and the Latin American private equity opportunity.

January 7, 2014More -

Supply-Chain Gains: How Greenbriar Partnered with GENCO

Transportation-focused private equity firm Greenbriar and its investment in logistics company GENCO.

December 27, 2013More -

The Year Ahead for PE-backed IPOs

What lies ahead for PE-backed IPOs in 2014, according to EY’s Global Deputy Private Equity Leader Mike Rogers.

December 27, 2013More -

Measuring “Impact”

How do private equity firms measure and report non-financial results?

December 27, 2013More -

Exploring Exits in African Private Equity

New research explores the issues of value creation and exits in African PE.

December 27, 2013More -

Doors to Growth: How FFL Added Operating Value to C.H.I.

Aaron Money and John Roach of FFL discuss their investment in garage-door manufacturer, C.H.I.

December 16, 2013More -

How The Riverside Company Grew AIA Corporation

How Riverside partnered with promotional products marketing franchise AIA to grow.

December 10, 2013More -

Preparing for an “Intense” Sale Process

The process of preparing a private equity portfolio company for exit is becoming more and more intense.

December 10, 2013More -

Expert Q&A With Philippe Leroy of EY

An expert conversation about preparing for an exit with Philippe Leroy of EY.

December 10, 2013More -

Capital Scarcity and Emerging-Market Entrepreneurs

Even emerging-market entrepreneurs for whom capital is not scarce find value in partnering with PE firms.

December 4, 2013More -

Expert Q&A With Jon Shepard of EY

Learn from an expert about EY’s Enterprise Growth Services program.

December 4, 2013More -

The Rise of Impact Investing

The growing popularity of “impact investing” in emerging markets private equity.

December 4, 2013More -

Latin American Exit Markets

All about the private equity exit markets in Latin America with experts from 3i, Abraaj, and EY.

November 25, 2013More -

How PE Helps Latin American Businesses Grow

Hear insights from three experts into how private equity firms partner with Latin American businesses to change and grow.

November 14, 2013More -

Expert Q&A with Michael Rogers of EY

Michael Rogers of EY explains how his firm helps private equity investors find success in emerging markets.

November 13, 2013More -

PE-Backed IPOs in Q3 2013

Michael Rogers, EY’s Global Deputy Sector Leader, discusses how 2013’s strong economic forecast performed for global IPOs and how 2014 looks.

October 31, 2013More -

Sandile Hlophe on EY & AVCA’s African Exits Report

Sandile Hlophe of EY discusses the findings of EY & AVCA’s recent African exits report.

August 30, 2013More -

African Deal Dynamics: Unlocking Value Creation

In Part 3 of Value Creation in Africa, GPs share real success stories from the region’s frontier markets.

August 28, 2013More -

Pulling the Lever on Value Creation

Part 2 of a series focuses on how private equity adds value to portfolio companies in Africa.

August 12, 2013More -

Africa: Home of the PE Exit

Want to understand the exit market in South Africa, North Africa, and across the continent?

July 30, 2013More -

Profitable, Responsible Real-Asset Investing

Real-asset investing in Brazil can be lucrative, provided you understand the municipal process of auctioning assets, according to our experts in this third segment of a series on real assets in Brazil.

July 24, 2013More -

Sourcing, Financing & Closing Deals

Veterans from Denham, Vision Brasil and EY discuss how they source and close deals, and the sources of debt financing for Brazilian real asset deals.

July 1, 2013More -

PE Capital Confidence Is Up

Mike Rogers on the main findings of EY’s recent PE Global Capital Confidence Barometer report.

July 1, 2013More -

Why Distinctive PE Firms Will Flourish

Michael Rogers, global deputy sector leader of private equity at EY, on why standing out from the crowd is more crucial than ever for PE firms.

June 7, 2013More -

Private Equity IPO Exits, Q1 2013

Michael Rogers, Global Deputy Sector Leader at EY, on what drove the momentum for private equity IPO exits in the first quarter of 2013.

May 17, 2013More -

Expert Q&A With Gustavo Gusmao, EY

Expert Q&A with Gustavo Gusmao, Executive Senior Manager, Lead Advisory – Public Sector at EY Terco.

May 15, 2013More -

Infrastructure Investing in Brazil: Filling Gaps

Our expert panel explains how macroeconomic drivers and a demographic shift in consumer power are leading to fresh infrastructure investment opportunities in Brazil.

May 13, 2013More -

ESG Case Studies and Cautionary Tales

Three emerging markets private equity veterans share stories and cautionary tales about how ESG (environmental, social, governance) programs have protected and created value .

March 13, 2013More -

Asia-Pacific Private Equity Outlook 2013

Mike Buxton, Private Equity Leader of Asia-Pacific for EY, gives an overview of the findings of the most recent “Asia-Pacific Private Equity Outlook” report.

February 20, 2013More -

Evolving Business Culture in Brazil

Profits used to be something to hide from the tax man in Brazil, according to Andre Viola Ferreira of EY Terco.

February 20, 2013More -

PE Confidence in a Tough Market

Findings of the latest EY Capital Confidence Barometer, which measures the confidence of participants in the M&A market.

February 19, 2013More -

Entrepreneurs and Growth in the Americas

Entrepreneurs and growth-stage companies are critical to economic growth, and EY is committed to supporting the ecosystem surrounding entrepreneurs, says to Herb Engert, Americas Strategic Growth Markets Leader at EY.

February 14, 2013More -

Colombian Confidence

Philip Bass of EY discusses the Colombian findings of a recent M&A survey.

February 8, 2013More -

Exit Planning Starts Early

The importance of an alignment of interest between the entrepreneur and the private equity sponsor in planning for an exit.

February 8, 2013More -

Growth Investors Tell Obstacle and Success Stories

Firing a family member–it is hard to find a more gut-wrenching decision to make, yet the three experts who join this fascinating panel discussion have seen this drama unfold many times in private equity-backed businesses.

January 30, 2013More -

GP “Buy-In” for ESG Implementation

The second in a three-part series on ESG in emerging markets private equity, with Jeremy Cleaver of CDC Group, Dushy Sivanithy of Pantheon Ventures, and Sandile Hlophe of EY.

January 30, 2013More -

Cordiant’s Emerging World View

From Montreal, David Creighton oversees an investment business that has placed equity and debt in private companies across 55 different emerging markets.

January 30, 2013More -

Technology M&A and the Private Equity Opportunity

Jeffrey Liu of EY Capital Advisors gives an overview of M&A trends in the technology space.

January 22, 2013More -

Marriage Tips for Entrepreneurs and Their Capital Partners

How to find a long-term partner in private capital, with Chris Masto of FFL, Jeffrey Bunder of EY, and Deepak Sindwani of Bain Capital Ventures.

January 22, 2013More -

Oil and Gas Deal Dynamics

New dynamics in the Oil & Gas M&A markets globally: a Privcap conversation with Ronald Montalbano of EY Capital Advisors.

January 22, 2013More -

PE-Backed Exits in Europe

Sachin Date–Private Equity Leader for Europe, Middle East, India and Africa at EY–discusses recent findings of a study of private equity-backed exits in Europe. Sponsored by EY.

January 9, 2013More -

Hot Spots in African Deal Flow

Our three African experts discuss private equity deal flow and investment theses in three key sectors – financial services, agribusiness and telecom.

January 9, 2013More -

What It’s Like to Be a Growth Company

What are the growing pains of companies at the growth stage? With Chris Masto of FLL, Jeffrey Bunder of Ernst & Young, and Deepak Sindwani of Bain Capital Ventures.

January 7, 2013More -

Expert Q&A With Jeffrey Bunder of EY, 2013

Jeff Bunder of EY discusses growth-stage companies.

January 4, 2013More -

Exit Planning Is a Must

Interview with Sachin Date, Private Equity Leader for Europe, Middle East, India and Africa at EY.

December 21, 2012More -

Choppy 2012 For PE-Backed IPOs

Jeffrey Bunder, Global Private Equity Leader for EY, shares his observations on 2012 private equity-backed IPOs and why this critical market remains flat relative to the prior year.

December 21, 2012More -

Outlook 2013: Private Equity in India

2013 outlook from Mayank Rastogi, a partner in the Private Equity and Transaction Advisory Services division of EY India.

December 20, 2012More -

The Challenges of Emerging-Markets Entrepreneurship

The unique challenges of entrepreneurs in emerging markets – a Privcap conversation with Maria Pinelli of EY.

December 19, 2012More -

How ESG Creates Value in Emerging Markets

How ESG adds value in emerging markets private equity, with Dushy Sivanithy of Pantheon Ventures, Jeremy Cleaver of CDC Group, and Sandile Hlophe of EY.

December 18, 2012More -

The African Consumer

A look into the young and growing African consumer population, with Hurley Doddy of Emerging Capital Partners, Fash Sawyerr of Actis, and Graham Stokoe of EY.

December 17, 2012More -

Myths and Facts in African Private Equity

Experts at Emerging Capital Partners, Actis, and EY discuss investor interest in Africa, including misperceptions, myths, challenges, and opportunities in a dynamic and growing region.

December 17, 2012More -

Women Entrepreneurs Must Scale

Top tips for female entrepreneurs from Kay Koplovitz, Chairman of Springboard Entreprises and Founder of USA Network, and Kerrie MacPherson, Principal and Entrepreneurial Winning Women Executive Sponsor, EY.

December 12, 2012More -

Expert Q&A With Sandile Hlophe, EY

Sandile Hlophe speaks with Privcap about the investment framework necessary for successful investing in Africa and the importance of local knowledge.

December 11, 2012More -

Expert Q&A with Graham Stokoe, EY, 2012

Graham Stokoe of EY discusses what investors need to know about Africa and how EY can help.

December 4, 2012More -

Outlook 2013: The Tech Space

Predictions for the technology space from Jeffrey Liu of EY Capital Advisors.

December 1, 2012More -

Latin American Venture Capital

A discussion on the Latin American ecosystem linking entrepreneurs and venture capital firms, featuring experts from the Multilateral Investment Fund, Cap Ventures, EY, and HarbourVest Partners.

November 4, 2012More -

Latin American Energy: Two Case Studies

Scott Swensen, Managing Partner of Conduit Capital Partners, and Russell Deakin, Managing Director of Rio Bravo Investimentos, offer a behind-the-scenes look at two recent deals.

November 3, 2012More -

LatAm Energy Investing

Energy investment strategies in Latin America with Scott Swensen, Managing Partner of Conduit Capital Partners, and Russell Deakin, Managing Director of Rio Bravo Investimentos.

October 29, 2012More -

Partnering With Latin American Entrepreneurs

Private equity in Latin America is discussed with experts from EY, Nexxus Capital, and HarbourVest Partners.

October 5, 2012More -

What’s Next for Actis?

Jonathon Bond, Partner and Head of Fundraising at London-based Actis, details the reasons behind Actis’ deal with the UK government to buy back 40% of the firm that the partners did not already own, and gives his views on the emerging markets private equity opportunity.

August 18, 2012More -

India Ecosystem for Innovation

Will India’s bustling technology scene give rise to the next Google? It’s the wrong question, say three veterans of the private capital markets.

August 13, 2012More -

How Is Emerging Markets PE Performing?

Umberto Pisoni, Global Portfolio Head in the Private Equity and Investment Funds Department of the IFC, shares statistical findings from his private equity portfolio and discusses why emerging markets performance data has improved.

August 9, 2012More -

What LPs Think of Emerging Europe

Considering the challenges that beset the region, what are investor perceptions toward Emerging Europe right now?

August 7, 2012More -

Climate Change Capital

Chenggang Jerry Wu, Principal Investment Officer and Lead for Climate Change Funds in the Global Private Equity Funds Group of the World Bank’s IFC on battling climate change via the private markets.

July 17, 2012More -

Change and Exits in Brazil

Some 95% of Brazilian companies in the mid-market are family-owned; as a result, there have been few motivations for world-class corporate governance in Brazilian business.

July 1, 2012More -

Expert Q&A With Carlos Asciutti

Carlos Asciutti, Partner at EY, speaks with Privcap about helping Brazilian private equity firms become more successful.

July 1, 2012More -

Subcontinental Deal Flow

India has a huge population of people and private businesses and an impressive array of private equity firms, yet the private equity opportunity there faces significant challenges.

July 1, 2012More -

India’s Macro Story

Investors watching macroeconomic and regulatory challenges multiply in India have been wondering how India’s macro story will affect private equity performance.

July 1, 2012More -

Eastern Shock

An outside observer might surmise that private equity in Emerging Europe is tough-going right now. But long-term investors in these countries say that the economic picture is more nuanced.

July 1, 2012More -

What Happened to “Convergence”?

GPs and LPs alike were excited at the many ways that business between East and West would grow and synergize. Amid the wreckage of the Eurozone downturn, how does the convergence story look now?

July 1, 2012More -

Sugar Startup: How Gavea Backed Cosan

Analysis of the deal that saw one of the world’s largest sugar companies, Brazil’s Cosan, sell a $226 million stake in its logistics unit to Gavea Investimentos and TPG Capital.

June 1, 2012More -

Sense of Urgency

Private equity is playing a pivotal role in driving a new era of entrepreneurship and innovation in Brazil.

June 1, 2012More -

Emerging LPs

The rise of very well-capitalized investing institutions across the emerging markets is beginning to shake up the status quo of the global private capital industry.

May 1, 2012More -

Private Equity Brazil: The Facts

Latin America and, more specifically, Brazil, are the subject of greater investor attention and, not surprisingly, of more research initiatives.

May 1, 2012More -

Investing in Indian Consumers

In India, a huge population is increasingly able spending money on new goods and services, and this spells big opportunity for entrepreneurs and their private equity backers.

May 1, 2012More -

Expert Q&A With Philip Bass, EY

Philip Bass, Partner at EY, discusses how GPs are adapting to new environments, why the emerging markets are being pursued, and EY’s resources across the globe.

April 1, 2012More -

Emerging Markets Surge in 2011

Private equity fundraising around the world remains tough, but emerging-markets fundraising had a stellar year in 2011, according to recently released figures.

April 1, 2012More -

Emerging in the Portfolio

It is hard to find investors in today’s market who do not want increased exposure to the emerging markets. But what is the right way to allocate to emerging markets private equity?

April 1, 2012More -

Assessing the GP Team

Assessing the skills of a GP team is the hardest and most critical task in alternative investing and even more challenging across borders and cultures, and in developing economies.

April 1, 2012More -

Turkish Exit “Proof”

In order for private equity to thrive in a region, there must be exits. Turkey hasn’t seen many private equity exits over the years, but they are beginning to occur.

March 1, 2012More -

Turkish Deal Flow

Turkey’s economy is growing, but what does this mean for actual private equity investment opportunities in the country?

March 1, 2012More -

“Tremendous Maturation”

Turkey is turning the corner to becoming a much more mature private equity market, according to Jeffrey Leonard, President and CEO of Global Environment Fund.

March 1, 2012More -

“Demonstration Effect”

Private equity markets in emerging economies grow due to good stories and good data; our panelists discuss the evidence of private equity’s beneficial effects on development.

February 1, 2012More -

The Turkish Opportunity

Turkey is one of the fastest-growing economies in the world, but its penetration by private equity investors is minimal. This spells opportunity for private equity investors.

February 1, 2012More -

Expert Q&A With Demet Ozdemir, EY

Demet Ozdemir, Private Equity Leader of EY – Turkey, speaks about changes in the Turkish private equity market and stratgies to successfully invest in the country.

February 1, 2012More -

African Upside, African Downside

Three veterans of the African private equity market share stories of successful deals and bullets dodged across this continent of opportunity.

January 1, 2012More -

Success and Hard Lessons in the Emerging Markets

Three veterans of the emerging markets private equity opportunity share real stories of success, as well as cautionary tales.

January 1, 2012More -

Expert Q&A With Sachin Date, EY

EY’s Private Equity Leader for Europe, Middle East, India, and Africa speaks with Privcap about investing in traditional sectors in emerging markets.

January 1, 2012More -

Fostering Private Capital

Our expert panelists share views on how advocates for private capital have successfully spurred the development of this asset class in their home markets.

January 1, 2012More -

Development Equity

The understanding of private equity’s impact on emerging markets is still developing, as three veterans of emerging markets private equity attest.

January 1, 2012More -

African Deal Flow

Three investment veterans discuss the robust deal flow in Africa and how investors there are sourcing opportunities.

December 1, 2011More -

Expert Q&A With Jeffrey Bunder, EY, 2011

Jeffrey Bunder, Global Head of Private Equity for EY, on what investors need to know about adding value and corporate governance in the emerging markets.

December 1, 2011More -

Corporate Governance in the Emerging Markets

A key value-driver of private companies in the emerging markets is a set of “basic” corporate-governance best practices, often instilled by private equity sponsors.

December 1, 2011More -

Emerging Markets Value Creation

“The best way to gain exposure to the emerging markets is by direct investment, by private investment,” according to veteran emerging markets investor David Creighton.

December 1, 2011More -

Expert Q&A With Graham Stokoe of EY

Graham Stokoe of EY discusses what investors need to know about Africa and how EY can help.

November 1, 2011More -

Continent of Opportunity

Private equity in Africa is now a hot topic. Why is the continent drawing interest from private capital and talent, and how should this vast region be understood?

November 1, 2011More