The Rise of ‘Sell-Side Due Diligence’

Transcript Download Transcript

The Rise of “Sell-Side” Due Diligence

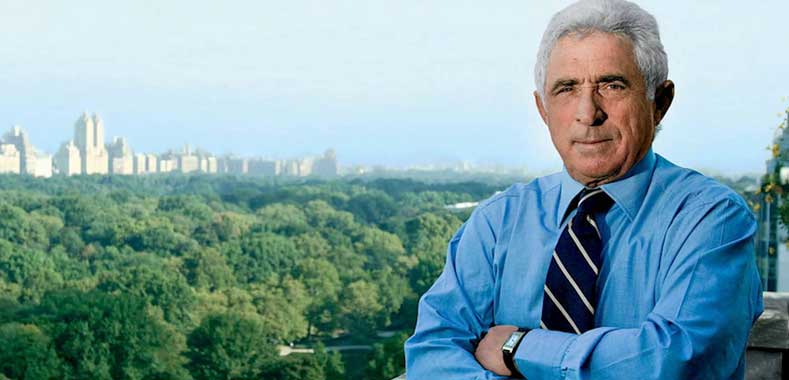

Jay Lucas, The Lucas Group:

We have seen a major trend in our business, toward doing what we call a “sell-side” due diligence. In other words, there may be a company that is getting ready to be sold. It may be owned by a private equity investor and there may be an investment bank involved in the process. We find it very valuable, really, at the very beginning of that sell process to actually do a market study.

The market study can be fairly comprehensive. It probably includes a number of customer interviews. It does things like gives an analysis of the competitive position of the company, putting that in the data room. Having that prepared report is just so incredibly valuable. Because what that means is that those 12 or 13 or however many potential buyers are coming in to take a look at the company. You’ve preempted many of the questions they’re going to be asking.

They might have questions about whether there was a loss of a customer or maybe some loss of some market share. Maybe [they have] other questions that you just want to head off at the pass. By having that market study in the data room, you’ve answered a number of those questions and you’ve professionalized the process.