Private Equity in 2016 – Emerging Markets

The top trends in emerging markets private equity, with expert commentary from EY and Actis.

Transcript Download Transcript

Private Equity in 2016 – Emerging Markets

With Peter Witte of EY

Macro Storms Dampen Deals

Peter Witte, EY:

The emerging markets, from a macro perspective, have seen some pretty rough winds over the last 12 to 18 months or so. For example, when we look at Brazil and Russia, they spent most of 2016 in fairly significant recessions. I think all four of the bricks, for example, are anticipated to be in positive GDP growth territory by midyear next year. It has certainly impacted deal activity. Deal activity, according to the latest stats from EMPEA, is down about 16% versus last year. And it’s certainly impacted fundraising as well.

LPs Having Second Thoughts

Witte: PE firms have raised about $18 billion through the end of the 3rd quarter, which is down about 35% versus 2015, so it’s a significant decline. At the same time, it’s not wholly unexpected.

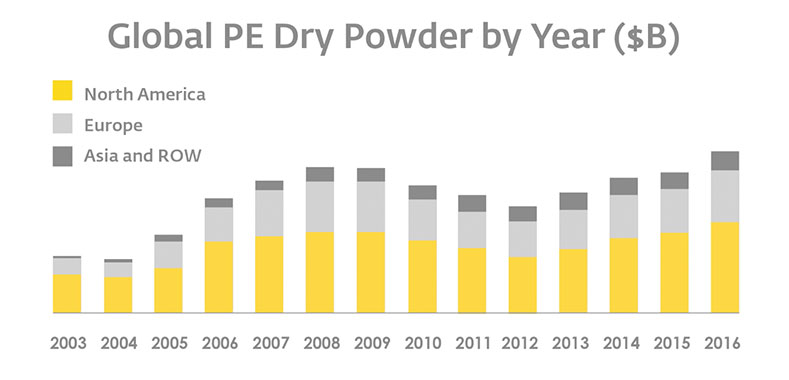

PE firms have raised a lot of capital for the emerging market—about $300 billion for the emerging markets—over the last five years or so. A lot of that money has yet to be spent. So there’s a lot of dry powder out there that’s focused on the emerging markets. Beyond that, I think LPs are looking at some of the investment activity—in particular, exits—and they haven’t seen the level of exits yet that they want to see before committing additional capital to the region.

A Good Year for Emerging Markets-Focused Actis

Natalie Kolbe, Actis:

In 2016, we saw good deal flow for Actis. We invested in five businesses across all of our markets, from Latin America all the way across to China and in the different sectors that we’re in. So, it was actually a good, consistent level of deal flow that we saw in 2016.

The businesses we look to invest in are supported by secular growth trends in our market. So, we invest in businesses that are supported by trends that are not disconnected, but are somewhat immune to what is happening in the macro economy.