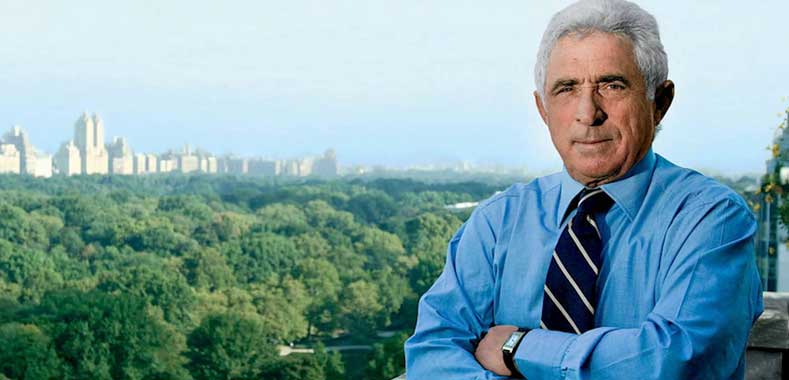

Powerhouses in Private Equity: Tom Lister, Permira

Permira’s Tom Lister talks about the culture of the global firm, how sellers see Permira as a valuable partner, and how he has structured a successful leadership with his co–managing partner in London.

Transcript Download Transcript

Powerhouses in PE: Tom Lister of Permira

Don Lipari, RSM:

Hi, I’m Don Lipari. Welcome to another segment of Powerhouses in Private Equity. Today I’m joined by Tom Lister, co-managing partner of the global private equity firm, Permira.

Tom Lister, Permira:

Hi. Nice to see you.

Lipari: In 2005, you leave Forstmann. You are drawn to Permira.

Lister: I thought about the choice to come to Permira really in the context of what were the international firms who had great track records and didn’t have a strong North American business? There were a few on the lists. As I was thinking about that analysis, somebody from Permira contacted me and that led to a development over six to nine months of a U.S. strategy of how to build a North American business at Permira.

At the time, there were a couple of people who worked at Permira who were here in North America, but by no means was it a fully built-out, fully-fledged business. That was really the appealing part of the opportunity and that’s what led me to come in the fall of 2005.

Lipari: In 2005, you join as a partner; in 2008 (timing is everything in life), you are promoted to co-managing partner along with Kurt Bjorklund. What’s going on in 2008? You had closed fund IV in ’05, ’06. And now, congratulations—here’s the key to the washroom and, by the way, we’re going through a global financial meltdown.

Lister: That’s very funny. If you describe that in hindsight, those are all totally correct statements. At the time, of course, when you’re there, you don’t really think about it in retrospect or with the perspective of all those facts, so we were asked to co-run the business, Kurt and I. We didn’t actually know each other particularly well. We’d been partners, but in two different geographies. We worked on a few things together—actually, in the spring of 2007, we were asked to run the off-site together. I suspect that probably wasn’t a coincidence, but that was really the first time we worked on a project together. Then, during the course of the summer of 2007, the partners, some of the more senior partners, asked us how we would think about running the business—what we would do with the business, how we would think about growing the business.

Then, in January of 2008, we set about this journey to co-run the business together. And you could give me all these facts that took place, right? Valuations fell, there was difficulty in raising private equity. They were all—part of what we managed through and against, but it was really a function of the fact that there was a set of partners at the time who were totally committed to the firm and the business who wanted to make the business and the firm a success. We fought through what was a longer financial crisis than you might have expected and came out the other side, actually, in quite good shape.

Lipari: Talk a little bit about what it’s like to co-lead a private equity firm.

Lister: It’s been an incredibly good model for us. I can’t imagine doing this job alone. It’s a big footprint, it’s a big firm. There’s a number of portfolio companies across a very wide span of time zones. I think it helps a lot that Kurt and I are not in the same place. He lives in London, I live in New York. We always say to the organization, “It’s rare, it’s not very often that you see the two of us together, but you should assume that the two of us think about managing the business, leaving the business as one.”

When we first got our job there was, of course, the natural tendency as there is in the fifth grade to try to go around if you didn’t like the answer you got from one and go for the other answer.

Lipari: Sure.

Lister: And I think we fairly successfully tamped that down and stamped that out. The partners in the business—so we, the partners, about 25 of them—we own the business together, collectively. So, we think of ourselves all as owners. That made a huge difference in how we tackled things.

Lipari: When you think about Permira, what makes this organization great?

Lister: We have a three-word moniker about how we describe our culture, which is “partnership, creativity and integrity.” And it’s really about the culture of the firm. As I mentioned earlier, it’s owned by the partners—that’s an incredibly important part of the culture. It’s about partnership, right? So, it’s a shared challenge, it’s a shared problem and it’s a shared success.

With respect to creativity, we take on things that are complicated. We do better in complicated situations—situations that involve multiple offices, multiple sector teams. Part of that is a function of our compensation system. One of the best things that Kurt and I inherited was the compensation system. We’ve hardly touched it at all. It’s based on the success of the overall firm, not any individual person. So, you’re incented in that model to help your partner be successful. And there are no big personalities or superstars in the business. That’s incredibly important in terms of the culture, right?

Lipari: Today’s sellers have so many options. Too many dogs chasing too few cats. What is Permira’s value proposition as you explore transactions?

Lister: We’ve worked very hard on that since 2009 and I think it really focuses on a couple of important things. First of all, treating the management teams that we back as partners. I talked about partnership as one of the key pillars of how the firm works. Helping them invest in their business and grow their business, not cost-cut their way to success.

Yes, you can cost-cut to improve your performance, but you can never cost-cut yourself to an outsized return.

Second is we’ve made a big investment in a platform that provides help for the portfolio companies, but doesn’t overwhelm them. So, we have a team of about 11 experienced executives, operating executives, who work with those portfolio companies. They’re supportive of the CEOs on the one hand and they’re not domineering of the portfolio company CEOs on the other hand. That’s a very hard balance to strike.

Lipari: Sure.

Lister: When Kurt and I got our job, we didn’t have any of that organization. In fact, there was a pretty fierce resistance to the inclusion of that as part of what we did. People would say, “Well, I’m the deal partner. I’m responsible for that. That’s what I should be doing.” And I think, over the 10 years that we’ve been at this, we’ve made a very good step towards a collaborative effort from the beginning of due diligence to the ultimate exit of working with the portfolio company CEOs, but not forcing them, dominating them or doing something that didn’t allow them to lead.

I think the last thing is we’ve made a big investment in sector expertise. We have five sectors around the world. We invest in talent in those sectors. If you meet a partner who leads one of our five sectors and you compare them to their peers in other of our private equity firms against who we are in that case competing for the opportunity to make the investment, they do extraordinarily well.

Now, it’s a very competitive market, so we don’t always win. Sometimes we lose on price, sometimes we lose on the fact that a management team concludes that another of our peers has some of those characteristics I just outlined and are more applicable for the situation.

Lipari: Talk about what’s next for Permira.

Lister: We sit in a really good place today. We’re cognizant of the fact that the world is complicated. If you look around the world, you don’t have to look, you can look in any of the jurisdictions and there’s something unusual going on. A couple of weeks ago at our investor meeting, I described it as a weird investing world, but in that weird investing world, there are still plenty of opportunities to make outsized returns. We have fantastic people.

One of the things that came from 2008, ’09 and ’10 was the opportunity for younger, then principals and investment professionals, now partners, to take big roles in the firm. They’ve done that. They’re sector leaders today and they, themselves, have developed terrific people underneath them. So, if you look at our team today, it’s in as good a shape as it’s ever been.

Lipari: Do you pull your Port. Co. CEOs, CFOs together within geographic regions?

Lister: Every 18 months, all the members of the boards, the CEOs and the senior leadership of the portfolio companies are invited to an event with Permira partners in which the content is some about Permira, some about getting to know each other and some about interesting things going on in the world. We get better feedback about that from our portfolio companies than almost anything we do. They always say, “I don’t really understand who my peers are. I don’t really have an access point where I can call a CEO of another portfolio company and say, ‘You know, if I can only solve this problem.'” So, that’s a big avenue.

They also find shared business opportunities. We’ve been doing that now for about five years and it’s been a hugely successful thing. Then, we also do something with functional expertise. We have a conference for all the HR officers around the Permira portfolio. Caroline Carr, who’s our CHRO, comes as well. And we work on talent development, reward policies, how we do things amongst the portfolio, sharing best practices. And, again, building a network of people. We do that with sales and demand generation and we’ll do that this year with all the general counsels of all our portfolio companies, not so much as a lecturer or training, but more as a way to connect and share best practices.