RSM

RSM is the leading U.S. provider of assurance, tax and consulting services focused on the middle market, with more than 6,700 people in 75 cities nationwide.

RSM is a licensed CPA firm and serves clients around the world through RSM International, a global network of independent assurance, tax and consulting firms. RSM uses…

Featured Experts

-

Laura Dietzel

Senior Manager, Real Estate Senior Analyst, RSM -

Anthony DeCandido, RSM US LLP

Partner, Financial Services Senior Analyst, RSM US LLP, RSM -

Timothy Byhre

Director, Financial Advisory Services, RSM -

Ben Gibbons, RSM Canada

National Private Equity Industry Leader, RSM -

Michael Mastruzzo

Senior Manager, RSM -

Joseph Dashuta

Partner, RSM -

John Rilling

Partner, RSM -

Troy Merkel

Partner, RSM -

Robert Langley

Partner, RSM -

Tauseef Ghazi

National Leader, Critical Infrastructure Security, RSM -

Melissa Brady

Director, RSM -

Gavin Backos

Principal, RSM -

Nathaniel Ruey

Partner, Risk Advisory Services, RSM -

Patrick Conroy

Partner, RSM -

Andrew Cohen

Senior Manager, RSM -

Nick Gruidl

Partner, Washington National Tax, RSM -

Stacy Dow

Partner, RSM -

Tom Lenz

Partner, Tax Services, RSM -

Mathew Talcoff

Partner, Tax Services, RSM -

David Van Wert, RSM

Partner, Transaction Advisory Services, RSM -

Aureon Herron-Hinds

National Leader of FATCA and Global Information Reporting Services, RSM -

Tommy Wright

Partner, Private Client Services, RSM -

Lindsay Hill

Director, Valuation Services, RSM -

Tom Leyden

West Region Lead, RSM -

Michael Fanelli, RSM US LLP

Partner, RSM -

Harshad Khurjekar

Director, Transaction Advisory Services, RSM -

Jonathan Caforio

Principal, Management and Technology Consulting, RSM -

John Hague

Partner, RSM -

Jason Sevier

Partner, RSM -

Christopher LaDue

Principal, RSM -

Steve Sprenger

Principal, RSM -

Carol Lapidus

Partner, Head of Consumer Products, RSM -

Don Susswein

Principal, RSM -

John McCourt

Audit Partner, RSM -

Andy Obuchowski

Director, RSM -

Keith Swiat

Director, Security & Privacy of the Northeast, RSM -

Blaine Clark

Director, Private Equity Consulting, RSM -

Joe Brusuelas

Chief Economist, RSM -

Dennis Cail

Director, Management Consulting, RSM -

Daimon Geopfert

Risk Advisory Services Group, RSM -

Bob Jacobson

Principal, Risk Advisory Services, RSM -

Tom Byrne

Director, Performance Improvement Consulting Services, RSM -

Don Lipari

National Industry Leader, RSM -

Matthew Reynolds

Director, RSM -

Dave Noonan

Principal, RSM -

Kevin Vannucci

Partner, RSM -

Colin Sanderson

Partner, RSM -

Cristin Singer

Partner, National Leader, RSM -

William Spizman

Partner, RSM -

Rick Bailine

Principal in Charge, Washington National Tax, RSM -

Steven Menaker

Partner, RSM -

Michael J. Grossman

Principal, Transaction Advisory Services, RSM -

Tammy Hill

Partner, Transaction Advisory Services, RSM -

Michael Schwartz

Principal, RSM -

Tom Green

Partner, Assurance Lead, Great Lakes Region Lead, RSM -

Richard Edelheit

National Real Estate Industry Practice Leader, RSM -

Stuart Taub

Partner, Northeast Region Lead, RSM

Videos

-

Dealmaker Roundup: Q2 2019

Is valuation fatigue setting in? What does the tech IPO boom mean?

July 23, 2019More -

How Automation is Transforming Business Operations

Three experts in private equity value add discuss the incredible advances offered by automation – variously identified as artificial intelligence, machine learning and robotic process automation (RPA). Private equity firms are increasingly helping their portfolio companies automate tasks that were once manual, cutting expenses and improving accuracy in the process. The experts from General Atlantic,…

July 15, 2019More -

Flexibility: Crucial for Real Estate Investing

Three real estate investment professionals discuss the focus they put on flexible real estate when considering investments.

July 8, 2019More -

Physical Retail is Here to Stay

Part of the thought-leadership series: Real Estate in Rising US Cities. Rising US cities are attracting young people in droves who come for the jobs and the lower cost of living. What is the retail investment play in these areas, particularly when young people are more likely to use e-commerce to shop? Our three real…

June 10, 2019More -

Expert Q&A: Laura Dietzel of RSM US LLP

Laura Dietzel of RSM discusses the remarkable rise of innovations in automation that are affecting real estate data management.

April 30, 2019More -

Dealmaker Roundup: Q1 2019

Are sky-high multiples of EBITDA the new normal? The rise of non-bank lenders. Three experts discuss.

April 29, 2019More -

RE Deals in Thriving Cities With Lower Costs of Living

Real estate investing in secondary US cities.

April 29, 2019More -

The Trouble With Gateway Cities

Real estate investment: the trouble with gateway cities.

April 15, 2019More -

The Challenge of ESG Data-Gathering

How GPs cope with the massive amounts of data generated by ESG programs

March 29, 2019More -

How to Add ESG to a Private Equity Program

Anthony DeCandido of RSM and Paula Bosco of Activus Risk Management discuss the emerging importance of ESG in private equity.

March 19, 2019More -

Dealmaker Roundup: 2019 Outlook

Private equity deal experts explain why they are optimistic about the deal market in 2019.

February 19, 2019More -

In Canada, TorQuest is ‘Building a Community’

Why non-profit work is so important to TorQuest’s founder.

December 4, 2018More -

On-Demand Webinar: New Reporting Rules

An expert discussion focused on new AICPA guidance, changes to revenue recognition rules, new lease accounting standards, and more.

November 16, 2018More -

Powerhouses in PE: Up Close With a Veteran of Canada’s Middle-Market

An in-depth interview with the head of one of Canada’s most seasoned middle-market private equity firms.

November 12, 2018More -

Podcast: Q3 2018 Dealmaker Roundup

Experts from Harris Williams, Preqin and RSM explain why the hot economy drove a stellar market for dealmakers in Q3.

October 15, 2018More -

Protecting U.S. Oil & Gas from Cyber Attacks

The oil and gas industry is at risk for cyber attacks, and preparing for the next attack is more than just putting the right software in place. It’s about hiring the right people.

August 20, 2018More -

Protecting Your Firm’s IT and Infrastructure

Experts weigh in on fraud and cybercrime in real estate investing.

August 10, 2018More -

Key Risk: RE Investors Who Have Known No Pain

How proper risk management and strong compliance standards can protect the funds and assets of real estate investors.

July 30, 2018More -

-

Deal with IT Immediately

When you do an add-on and discover dozens of IT applications that need to be integrated…

June 29, 2018More -

-

Helping Clients Add Value Through M&A

Gavin Backos of RSM describes his firm’s integration services.

June 15, 2018More -

Cybercrimes Can Hit Real Estate Funds and Assets

To what extent are firms in the real estate industry exposed to cybercrimes, and how can managers spot major signs of an attack?

June 12, 2018More -

Strengthen Your Back Office, Lower Your Risk

Why operational due diligence is critical in managing all aspects of your back office.

June 11, 2018More -

New Mountain Capital’s Steve Klinsky: Leaving a Legacy

The founder and CEO of New Mountain Capital discusses a stunning a 40+ year in PE, why he started his firm and how important it is to leave a legacy.

May 25, 2018More -

Powerhouses in PE: Steve Klinsky of New Mountain Capital

When Steve Klinsky, CEO and founder of New Mountain Capital sat down with RSM’s Don Lipari, he described his youth growing up in a small suburb of Detroit to eventually build a powerhouse firm that today has raised over $17 billion in capital since 1999.

May 11, 2018More -

Advancing Research into Parkinson’s Disease

The head of Argand Partners, a private equity firm, discusses his transformative role at the Parkinson’s Foundation.

May 1, 2018More -

Powerhouses in PE: Howard Morgan of Argand Partners

From Castle Harlan to globally-focused Argand Partners.

April 30, 2018More -

Dealmaker Roundup | Q1 2018 Review

An analysis of the return of mega-deals in Q1 2018, as well as the “Golden Era” for add-ons. Featuring experts from Preqin and RSM.

April 13, 2018More -

-

Technology Will ‘Reembody’ Financial Services

What will “better, faster, cheaper” fintech mean for financial services?

March 13, 2018More -

The Changing Mix of Energy

Pine Brook’s Howard Newman shares his outlook for global energy demand.

March 13, 2018More -

Powerhouses in PE: Howard Newman’s ‘Serendipitous’ Success

How Howard Newman went from a small town to a large private equity firm.

March 12, 2018More -

The ‘Stunning’ North American Energy Network

An interview with RSM’s chief economist discusses how withdrawal from NAFTA could rock the global energy sector.

February 21, 2018More -

Michigan Will Be Hit Hardest by a NAFTA Withdrawal

How Michigan and other U.S. states will be affected by withdrawal from NAFTA.

February 20, 2018More -

How a NAFTA Withdrawal Would Harm the Middle Market

An interview with RSM’s chief economist on the impact of U.S. withdrawal from NAFTA.

February 16, 2018More -

Deals 2018: The Mid-Market is on Fire

The middle market is on fire, but mega-fund deals are not sufficient.

February 9, 2018More -

On-Demand Webinar: U.S. Tax Reform

An expert discussion of the sweeping changes to tax legislation and how the Tax Cuts & Jobs Act may impact your fund, firm, and portfolio companies.

January 31, 2018More -

Terrence Mullen: Leveraging Innovation, Creating Value

Why Arsenal Capital is so excited about the innovative companies it backs.

November 10, 2017More -

On-Demand Webinar: The Tax Consequences of GP Restructurings

An expert discussion amid record buying and selling of management-company stakes

November 8, 2017More -

Powerhouses in PE: Arsenal’s Painful Lessons

How two of Arsenal’s first three deals provided painful lessons.

October 27, 2017More -

What’s Ahead for Global Real Estate?

What’s ahead for global real estate investment, including the shifting tax and regulatory landscape.

October 20, 2017More -

Dealmaker Roundup Q3 2017

Why the dearth of mega-deals may be near an end; Asia volume explodes.

October 16, 2017More -

The Big Challenges for Global Real Estate Investors

A discussion of the legal and regulatory challenges posed by the influx of global capital into real estate.

October 6, 2017More -

Trends in Global Real Estate Investment

Insight on the current state of global capital flows, and how they impact real estate investment.

September 22, 2017More -

The Middle-Market Is Bullish on Infrastructure

RSM’s Chief Economist discusses the new and rapidly evolving economy of infrastructure.

September 15, 2017More -

Permira’s Success with Hugo Boss

Permira’s Tom Lister talks the firm’s highly successful Hugo Boss deal.

September 15, 2017More -

A Tale of Two Labor Markets

What to do about the need for high-skill workers and the disappearance of low-skill jobs?

August 21, 2017More -

Tom Lister: What I Learned From Ted Forstmann

Permira’s Tom Lister remembers his days with Ted Forstmann.

August 14, 2017More -

Powerhouses in Private Equity: Tom Lister, Permira

Permira’s Tom Lister talks about the “fantastic” culture of the global firm.

August 10, 2017More -

Fundraising Roundup Q2 2017

Current reports indicate a new golden era for fundraising.

July 27, 2017More -

Dealmaker Roundup Q2 2017

“Why aren’t there more big take-privates like Staples happening?”, ask deal veterans

July 18, 2017More -

On-Demand Webinar: Why IRS PE Audits Are About to Ramp Up

Why you need to re-write your partnership agreements—Now

June 14, 2017More -

“Black Swans” in Energy

RSM and TPG discuss outlier events that could rock the markets.

June 9, 2017More -

An Investor’s ‘Lifetime’ Commitment to Notre Dame

Jay Jordan reflects on his passion for Notre Dame University as a trustee and former alum.

May 26, 2017More -

Jay Jordan: A Tech Future for U.S. Manufacturing

Will there be a rebirth of US manufacturing?

May 26, 2017More -

TPG: Investing in the Energy ‘Bottleneck’

Why deregulation will unleash a wave of private capital in the oil and gas space.

May 8, 2017More -

New Paradigm: Oil, Gas and the U.S. Middle Market

Why deregulation will unleash a wave of private capital in the oil and gas space.

May 3, 2017More -

Inside The Surge in Software Deals

Why valuations are surging and hold periods shortening for software deals.

May 3, 2017More -

Powerhouses in PE—Jay Jordan of The Jordan Company

How a ‘Missouri boy’ founded what is today a dominant middle-market buyout firm.

April 28, 2017More -

The Risks of a WeWork Tenant

Co-working office providers like WeWork are quickly becoming the biggest lessees in the US. What does this mean for investors in office properties?

April 21, 2017More -

Dealmaker Roundup Q1 2017

Deal activity from the first quarter of 2017 is discussed – including the observation, “Where were the mega-deals?”

April 17, 2017More -

When IT Upgrades Go Smoothly (or Don’t)

What a successful IT upgrade looks like, and what signs of trouble look like.

April 14, 2017More -

Investing in ‘Creative’ Office Space

Why old Park Avenue office buildings are risky.

April 7, 2017More -

ERP Upgrade Success Stories

Stories of success attributed to better data systems in the CFO’s office.

March 24, 2017More -

Reimagining Retail

How millennial e-commerce habits are upending malls and driving logistics deals.

March 24, 2017More -

Moving From Diligence to Action Plan

The deal is done and the finance team is exhausted – time to get busy with a major ERP upgrade!

March 17, 2017More -

Real Estate Underwriting in 2017

Michael Schwartz of RSM discusses rising interest rates and risk appetite among real estate investors.

March 10, 2017More -

The Globalization of RE Capital Will Continue

An RSM real estate expert predicts continued flow of foreign capital to US property.

March 10, 2017More -

Investing in a Rental Nation

Millennials want to rent – here’s how they’re redefining real estate investing.

March 10, 2017More -

A Career Built on Emotional Intelligence

How Stewart Kohl’s career in private equity was driven by an ability to connect with people.

March 3, 2017More -

IT Due Diligence Done Right

Dave Noonan of RSM describes his firm’s approach to IT due diligence and how this supports a private equity investor’s ability to create value.

March 3, 2017More -

‘Need to Know’ is the New ‘Nice to Know’

With access to incredible data analysis tools, the CFO has become a key player in private equity value creation.

March 3, 2017More -

Dealmaker Roundup – Private Equity 2016 Review & Outlook

What drove private equity deal activity in 2016 and what are the top predictions for deals in 2017?

February 15, 2017More -

Why Riverside Loves the Global Lower-Middle Market

The Co-CEO of Riverside explains the appeal of the lower middle market.

February 13, 2017More -

Trends in U.S. Manufacturing

How a strong dollar and scarce skills are affecting U.S. manufacturing.

January 27, 2017More -

Valuing Upstream Energy in 2017

Steve Sprenger of RSM US LLP discusses the complexities of valuing upstream energy companies, and what price stability means for profitability.

January 27, 2017More -

On Demand Webinar: Carried Interest and GP Estate Planning

What every private fund professional needs to know about taxes, valuation and wealth transfer.

November 16, 2016More -

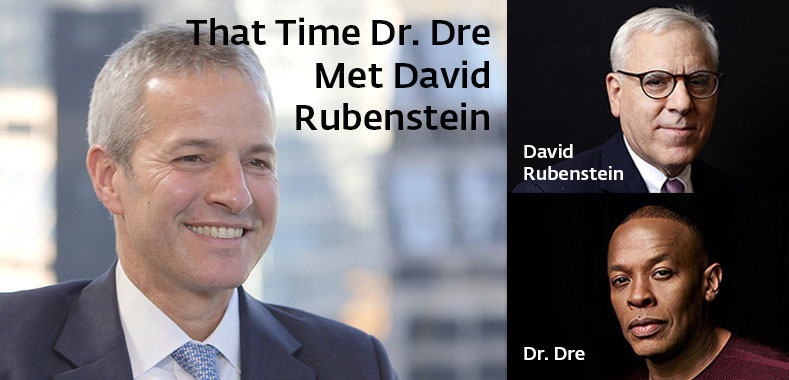

That Time Dr. Dre Met David Rubenstein

How Carlyle sourced the Beats deal, and how the meeting between two titans from different worlds happened.

October 28, 2016More -

Career Talk: From Law to Carlyle Group

The partner who leads Carlyle’s middle-market investment group discusses his career path.

October 28, 2016More -

A New Paradigm for Reporting Fees and Expenses

The SEC is turning its sights on the real estate sector in regard to the reporting of investment-level and fund-level fees and expenses. What are the compliance and operational challenges facing real estate GPs and what best practices are being adopted in the industry? How do LPs view the fee reporting issue?

October 26, 2016More -

Dealmaker Roundup Q3 2016

Privcap’s new quarterly video series featuring expert insights on the private equity dealmaking environment.

October 17, 2016More -

Carlyle’s Mid-Market Team: We Have a Mega Advantage

How Carlyle’s middle-market team looks for value as well as benefits from the mega-deal team expertise.

October 14, 2016More -

Why ‘Open and Transparent’ Brands Win

Consumer-facing businesses need to throw out the old rule book of marketing in the era of social media.

September 6, 2016More -

Watch Privcap & Preqin’s Dealmaker Roundup, Q2 2016

Privcap’s new quarterly video series featuring expert insights on the private equity dealmaking environment.

July 29, 2016More -

The Big Trends Driving Consumer & Retail

Two experts discuss what the next recession might look like, and the right consumer sectors to invest in to weather the storm.

July 22, 2016More -

How Volatility Impacts Energy Valuations

Due to the prolonged period of low oil prices, GPs and LPs are changing how they look for deals. Experts from Aberdeen Asset Management, WL Ross and Co., and RSM discuss how investors need to adapt their valuation approach to indeterminate prices, why investors will see more aggressive writedowns and consolidation, and where in the value…

July 5, 2016More -

Why Millennials Will Move to Chattanooga Over NYC

Debt-ridden millennials could turn their backs on cities such as New York and San Francisco in favor of Detroit, Milwaukee and Chattanooga in the search for affordable homes and good schools.

May 29, 2016More -

The Black Box is No Longer Your Own

Experts from RSM, Alpha Parity and Sprott Asset Management discuss the opening of a hedge fund’s “black box,” and the rising power of allocators vs. star managers.

May 12, 2016More -

New Rule: Transparency & Sophistication Reign

Three experts discuss the growing demand for transparency and sophistication by hedge fund investors.

May 12, 2016More -

Valuations and the ‘Unicorn’ Phenomenon

Two experts explain the impact of the “unicorn” phenomenon on private equity and venture capital valuations.

April 24, 2016More -

The Right Way to Break Up a JV

The best JV is one that plans, from the outset, how to divorce gracefully should one partner need to exit early, according to a discussion featuring Taconic Investment Partners, TIAA and RSM.

April 17, 2016More -

The Use of ‘Calibration’ in Valuations

Two experts explain the concept of “calibration” and its growing importance in PE and VC valuations.

April 3, 2016More -

How Detailed Should Your Valuation Policy Be?

Three experts share their approaches to forming and following valuation policies.

March 20, 2016More -

Don’t Overthink—and Overdo—TIs

Landlords can avoid overpaying for tenant improvements by having a clear understanding of their prospective tenant, say experts from Taconic, TIAA and RSM.

March 20, 2016More -

Expert Q&A: With Jason Sevier of RSM

The urbanization trend isn’t killing the suburbs and could, in fact, create opportunities to transform them, says RSM partner Jason Sevier

March 20, 2016More -

Expert Q&A with John Hague of RSM US LLC

John Hague of RSM explain how the firm services hedge fund clients.

March 12, 2016More -

Assessing the Debt Opportunity in Energy

Melissa Brady of RSM US LLP discusses opportunities in distressed debt, what the pitfalls can be for investors if they misprice debt, and the impact of the illiquidity in the market.

March 4, 2016More -

Carve-out Complexities: Multiple Locations

RSM’s Dave Noonan explains firm’s Rough Order of Magnitude due diligence service, designed to help private equity clients predict the costs of a carve-out transaction during the critical pre-deal phase.

October 28, 2015More -

Do You “Calibrate” Your Valuations?

Auditors expect PE firms to “calibrate” their valuations. Experts define what this means.

May 21, 2014More -

Using “Comps” the Right Way

The right and wrong ways to use public-market and other “comparables” in PE valuations.

April 30, 2014More -

Expert Q&A with Rick Bailine of RSM

An expert Q&A with tax expert Rick Bailine of RSM.

April 7, 2014More -

How to Subtract Value Via Bad Tax Moves

Two tax experts discuss transfer pricing and qualified stock purchases and how getting these wrong can end up subtracting value from a private equity deal.

January 20, 2014More -

Top Tax Trends – in Two Minutes

Top tax trends in private equity from a leading tax expert.

December 9, 2013More -

What Does the Scott Brass Case Mean for PE?

A key court case might put GPs on the hook for pension liabilities as well as raise taxes on carried interest.

December 9, 2013More -

Food: Constantly Disrupted by Innovation

Think the food market can’t be disrupted? Think again.

October 28, 2013More -

Deal Stories: Reinventing Frozen Food and Candy

PE vets discuss high-profile food deals, like Birds Eye frozen food, transformed by Vestar.

October 9, 2013More -

How PE & Manufacturing Companies Build Success

The fourth and final installment of Privcap’s series on The New U.S. Manufacturing Opportunity.

June 24, 2013More -

Deal Flow in a Competitive, Tech-Infused Market

Why are sellers selling in the revitalized U.S. manufacturing sector?

May 17, 2013More -

Healthcare Due Diligence and Dealbreakers

Part 4 in the dynamic series on investing in healthcare with James Elrod of Vestar Capital Partners, Sherrill Neff of Quaker Partners, and Tammy Hill of McGladrey.

January 22, 2013More -

What’s Driving Healthcare Deal Flow?

Three experts discuss the motivations and dynamics behind private equity deal-sourcing activity in the healthcare space. With James Elrod of Vestar Capital Partners, P. Sherrill Neff of Quaker Partners, and Tammy Hill of McGladrey.

January 14, 2013More -

Healthcare Thesis: Two GPs Share Deal Details

Hear two healthcare deal stories from the experts: Jim Elrod of Vestar Capital Partners, Sherrill Neff of Quaker Partners, and Tammy Hill of McGladrey.

December 17, 2012More -

How Risky Is Healthcare Investing?

Experts at Vestar Capital Partners, Quaker Partners and McGladrey discuss the regulatory, reimbursement and political risks at the heart of healthcare investments.

December 15, 2012More -

Expert Q&A With Tammy Hill

Tammy Hill, Managing Partner at McGladrey, speaks with Privcap about the challenges firms face within the healthcare sector and how her firm supports private equity investments in that sector.

December 15, 2012More -

Internet or Die

Private equity investors that can bring the capital required to internet-enable their consumer-facing portfolio companies will win big. With Michael J. Grossman of McGladrey, Joan McCabe of Brynwood Partners, and Timothy Mayhew of Fenway Partners.

November 1, 2012More -

Brynwood’s Zestfully Good Deal

Our experts sit for a broad discussion on extracting value, no matter where a product is in its lifecycle. With Joan McCabe of Brynwood Partners, Michael J. Grossman of McGladrey, and Timothy Mayhew of Fenway Partners.

October 1, 2012More -

Preparedness is Key in Cybersecurity

RSM’s Andy Obuchowski discusses how to prepare and respond to a data breach.

October 5, 2015More -

After the Add-on, Then What?

Why sourcing add-on acquisitions can take years, why investment bankers carefully “coach” management teams, and other insights into the buy-and-build strategy.

September 14, 2015More -

Cybersecurity: Protecting Financial Data

RSM’s Keith Swiat explains how easily cybercriminals can obtain credit card information.

August 31, 2015More -

Sourcing and Vetting Add-on Acquisitions

Why sourcing add-on acquisitions can take years, why investment bankers carefully “coach” management teams, and other insights into the buy-and-build strategy from three experts.

August 3, 2015More -

Healthcare Data Deals Heavy on Homework

RSM’s Tammy Hill tells Privcap what’s required of investments in healthcare data collection, and why some are leery of the privacy risks involved in gathering this kind of information.

July 27, 2015More -

Expert Q&A With Dennis Cail of RSM

Dennis Cail of RSM describes his firm’s work with private equity firms in buy-and-build investments.

July 6, 2015More -

The Real Economy: Investing in Office Transformation

U.S. suburbs and ex-urban core are staged for a commercial real estate development come back as the Millennial cohort ages and starts having families, says RSM’s Joe Brusuelas and Cornerstone Real Estate Advisers’ Jim Clayton.

June 29, 2015More -

-

The Real Economy: Investing in Real Estate

Demographics and changing preferences could spell a different residential and commercial real estate recovery than past cycles, say RSM’s Joe Brusuelas and Cornerstone Real Estate Advisers’ Jim Clayton.

June 25, 2015More -

PE Consulting: Optimizing IT

In a private equity environment, IT is a complex situation given the compressed timeframe for a return on investment. Performing IT due diligence is key, says RSM’s Blaine Clark.

June 23, 2015More -

Behavioral Healthcare Overcomes Stigma

RSM’s Tammy Hill discusses opportunities for PE investment in behavioral healthcare, both in the long term and short term.

June 22, 2015More -

The Transition Services Agreement

Experts from RSM, Vestar Capital Partners and J.F. Lehman detail what goes into a transition services agreement, which governs the setup of a carve-out transaction.

June 8, 2015More -

PE Consulting: Carve-outs

While every private equity deal has its own set of complexities, carve-outs are particularly challenging, says RSM’s Blaine Clark.

May 26, 2015More -

What Happens After a Carve-Out Is Executed?

Giving a carve-out company the ability to operate from its first day of standalone status is an intricate accomplishment, say experts from RSM, Vestar and J.F. Lehman.

May 26, 2015More -

Expert Q&A With Blaine Clark of RSM

RSM’s Blaine Clark explains key points of differentiation in the firm’s private equity consulting business.

May 19, 2015More -

Cybersecurity: Threats Every GP Should Understand

RSM’s Daimon Geopfert discusses how firms should approach their cybersecurity strategies.

May 18, 2015More -

The Art of the Carve-Out

Experts from J.F. Lehman, Vestar Capital and RSM explain the carve-out process, including sourcing, transactions and value creation.

May 11, 2015More -

PE Consulting: Value Creation

With multiples being so high in the current economic cycle, value creation has become a central point of differentiation for GPs, says RSM’s Blaine Clark.

April 22, 2015More -

Enacting Change in Portfolio Companies

A discussion of how operating partners are involved in enacting change in a new portfolio company and the skills needed to prepare for an exit, with RSM’s Mauro Bonugli.

February 25, 2015More -

Who’s on a Value-creation Team?

RSM’s Mauro Bonugli explains who at a private equity firm should be involved in a value-creation plan for a newly acquired company.

January 26, 2015More -

Why Baird Backed Integrated Diagnostics

An in-depth discussion among three experts about the dynamics between a private equity firm and their portfolio companies.

January 12, 2015More -

Arsenal’s 90-day Plan for Chromaflo

Arsenal Capital’s Tim Zappala, Chromaflo’s Scott Becker and RSM’s Mauro Bonugli discuss how Arsenal implemented Chromaflo’s 90-day plan and what it achieved.

December 29, 2014More -

Why Chromaflo Chose Arsenal

Arsenal Capital Partners’ Tim Zappala, Chromaflo’s Scott Becker and RSM’s Mauro Bonugli discuss how Arsenal came to invest in Chromaflo.

December 15, 2014More -

How Operations Experts Impact Due Diligence

Operating partners speed up due diligence and help relationships with current management of possible portfolio companies, says Mauro Bonugli of RSM.

December 5, 2014More -

How Operations Experts Enhance Deal Sourcing

Operating partners lend expertise to deal sourcing in two main ways, says RSM’s Mauro Bonugli: developing investment theses and tapping into their networks.

November 7, 2014More -

Full Disclosure: How Operating Partners Get Paid

Why the SEC is interested in how operating partners get paid by private equity firms.

August 12, 2014More -

Compliant Enough? Think Again

Why the SEC is interested in a private equity firm’s compliance program.

August 12, 2014More -

Valuations Without Conflict

The SEC is increasingly focused on the valuation procedures in place at private equity firms.

August 12, 2014More -

RIA Rules Seem Strange to PE Firms

What GPs need to know about how the SEC views the compensation of operating partners.

August 12, 2014More -

Hunting for Conflicts of Interest

The SEC’s increasing focus on finding potential conflicts of interest at private equity firms should have the attention of all GPs.

August 12, 2014More -

Operations in an Underperforming Portfolio Company

Stories about adding operating value in underperforming portfolio companies.

July 22, 2014More -

Management Buy-In: The Key to Operating Value-Add

All about the crucial relationship between portfolio company management and the operations team at the sponsoring private equity firm.

July 1, 2014More -

Expert Q&A with Dave Noonan of RSM

An expert conversation with Dave Noonan, National Director of Private Equity Consulting at RSM.

June 16, 2014More -

What Makes a Solid Operating Platform?

Execs from Riverside, MidOcean, and RSM compare their approaches to deploying operating talent in their investment processes.

June 16, 2014More -

PE Valuations: Why Options Pricing Doesn’t Cut It

The options-pricing model might be a buzzword in valuation circles, but it’s of little use to private equity CFOs. With experts from EIF, W Capital and RSM.

June 9, 2014More -

Valuing Energy Assets

The CFO of a major energy-focused private equity firm explains his approach to valuations.

June 9, 2014More -

Arsenal and Chromaflo: Adding Value

Experts discuss the challenges of integrating a company into a portfolio and how leaders from the portfolio and parent companies communicate with each other.

January 19, 2014More -

Valuation Challenge: Doubting the Last Round

You’ve invested in an early-stage company but don’t want to use the last round of financing as your value. Now what?

November 18, 2013More -

Expert QA with Steve Menaker of RSM

Steve Menaker, Partner at McGladrey, on the role of the the firm’s transaction advisory group as a client engagement grows and evolves.

May 10, 2013More -

Manufacturing-Sector Deal Dynamics

Part 2 of a series. What is driving private equity deal flow in the changing U.S. manufacturing space?

April 22, 2013More -

Driving Growth in Manufacturing

A Renaissance in U.S. manufacturing is underway and private equity firms are positioning themselves to help industrial companies take full advantage. The first of a multi-segment thought-leadership series.

April 1, 2013More -

How Fenway Saw Success with 1-800-CONTACTS

How do you make money in a consumer business that many customers view as commoditized? you win on service. With Fenway Partners’ Timothy Mayhew.

September 1, 2012More -

Investing in Consumer Success

How can GPs make money amid such weak consumer spending? With Michael J. Grossman of McGladrey, Joan McCabe of Brynwood Partners, and Timothy Mayhew of Fenway Partners.

September 1, 2012More

Reports

-

Executive Summary: Dealmaker Roundup 2019 Outlook

A digest of our recent expert discussion, featuring comprehensive data and essential expert takeaways for the deal market in 2019.

February 19, 2019More -

Report: Why You Need to Pay Attention to New Reporting Rules

An executive summary report on new AICPA guidance, changes to revenue recognition rules, new lease accounting standards, and more.

December 17, 2018More -

Real Estate Investment Excellence 2019

A compendium of the latest insights for institutional real estate investing.

November 12, 2018More -

Q3 2018 Dealmaker Roundup | Executive Summary

An expert analysis of the upward drift of deal sizes and valuation multiples, increasing aggressiveness of corporate buyers, and a surging healthcare market that skyrocketed M&A activity in Q3.

November 2, 2018More -

REgional Impact: New York City

Insights on the essential trends in New York City real estate, and how investor focus is shifting beyond Manhattan to the outer boroughs.

October 8, 2018More -

CFO Conversations: Complexity Forces CFOs to Stretch

How can “traditional” private equity CFOs navigate an increasingly challenging regulatory and tax landscape?

October 1, 2018More -

REgional Impact: Philadelphia

How are institutional real estate markets being affected in Philadelphia? Inside the City of Brotherly Love’s shift from fiscal struggle to a booming haven for millennials, culture, and affordability.

September 24, 2018More -

Profiles in Value Creation: FFL Partners and Crisis Prevention Institute

FFL Partners’ Cas Schneller and RSM’s Dave Noonan highlight the key steps taken to improve a business facing a highly challenging but opportune market.

September 7, 2018More -

Report: Emerging Risks in Real Estate Investing and Management

Key findings from the recent thought-leadership series, Risk and Real Estate Investment Excellence. Experts share key strategies on how to prevent fraud and cyber attacks, and how to best maintain your back office.

August 31, 2018More -

REgional Impact: Boston

An in-depth report on the current trends investors need to know about the Boston region. Featuring experts from Bain Capital Real Estate, GreenOak Real Estate, LaSalle Investment Management, and more…

August 6, 2018More -

Privcap Podcast: Dealmaker Roundup | Q2 2018 Executive Summary

Highlights from Privcap’s Dealmaker Roundup Podcast surveying Q2 2018’s deal activity and fundraising and performance.

July 27, 2018More -

Add-ons, Done Right

An executive summary of the Privcap thought-leadership series on the right ways to approach business integration.

July 24, 2018More -

The Revenue Recognition Standard: Why it Matters

Expert insights on how to best prepare your portfolio companies for new accounting standards.

June 12, 2018More -

Dealmaker Roundup | Q1 2018 Review Report

An expert discussion on the return of mega-deals, and the “Golden Era” for add-ons in the first quarter of 2018.

April 13, 2018More -

Report: The Impact of U.S. Tax Reform on PE

How the Tax Cuts & Jobs Act may impact your fund, firm, and portfolio companies.

February 23, 2018More -

Dealmaker Roundup: 2018 Preview Report

A recap report of private equity deal trends of 2017 and the most important action to watch in 2018.

February 16, 2018More -

Report: 2017 Real Estate Game Changers

A comprehensive recap from Privcap’s 2017 Real Estate-focused conference on November 2nd, 2017.

January 22, 2018More -

The Tax Consequences of GP Restructurings

Why GP restructurings are at record-setting levels in the current market.

December 11, 2017More -

Dealmaker Roundup: Q3 2017 Report

Why the dearth of mega-deals may be near an end, and why the biggest deals of the third quarter were in Asia.

November 6, 2017More -

The Globalization of Real Estate

An executive summary of the Privcap series on trends, challenges, and the future of global real estate investing.

October 20, 2017More -

2018 Portfolio Operations Yearbook

Best practices for private equity value-creation. Featuring experts from Blackstone, Oaktree, KKR, The Carlyle Group, and more…

October 9, 2017More -

Report: Real Estate Investment Excellence 2017

Executive insights for institutional real estate investing, featuring experts from KKR, Taurus Investment Holdings, NES Financial, and more…

October 9, 2017More -

2017 GP Operations Compendium

Insights on managing the complexities of today’s private equity firm.

September 6, 2017More -

Dealmaker Roundup: Q2 2017 Report

A comprehensive report of the tepid private equity deal volume of Q2 2017, and more…

August 4, 2017More -

The IRS Is Targeting Partnerships – Is Yours Next?

New audit rules have big implications for private equity and real estate investors.

June 29, 2017More -

The Millennial Impact on Real Estate

How is the largest generation in history influencing trends in the office landscape, retail, and real estate?

April 21, 2017More -

Report: Dealmaker Roundup Q1 2017

Expert discussion of deal activity from the first quarter of 2017.

April 19, 2017More -

-

Report: Energy Game Change 2016

A roundup of our latest private equity energy-focused conference in Houston, TX in December 2016.

February 24, 2017More -

The Real Economy: Trends in U.S. Manufacturing

Experts from The Carlyle Group and RSM US LLP discuss the outlook for the U.S. manufacturing sector.

February 23, 2017More -

What GPs Should Know About Carried Interest and Wealth Planning

An excerpt from the Privcap webinar “Carried Interest and GP Estate Planning”

December 12, 2016More -

How Real Estate GPs Can Handle Increasing SEC Scrutiny

An excerpt from the Privcap webinar “A New Paradigm for Reporting Fees and Expenses”

November 15, 2016More -

Report: Consumer & Retail Game Change 2016

Privcap Game Change: Consumer & Retail 2016, a debut event, brought together private equity investors, institutional investors, and executives from the consumer sector, all of whom are hyper-aware of one thing—massive technological disruption.

November 11, 2016More -

Dealmaker Roundup Q3 2016 Report

The report of Privcap’s new quarterly video series featuring expert insights on the private equity dealmaking environment. Featuring experts from Preqin, Harris Williams, RSM, & The Carlyle Group

October 17, 2016More -

Portfolio Operations Yearbook 2017

Insights from portfolio operations professionals on successfully managing private equity investments.

October 6, 2016More -

In Conversation with GreenOak, Andell, GTIS, Lowe and Mesa West

An executive summary of the Privcap Real Estate Forum in Los Angeles.

July 29, 2016More -

Privcap Preqin Dealmaker Roundup Q2 2016 (report)

A report based on a quarterly video series featuring expert insights on the private equity dealmaking environment.

July 29, 2016More -

GP Operations Compendium

While strong net returns remain the number one deliverable for private equity firms, returns minus evidence of sound firm infrastructure scares investors.

July 19, 2016More -

In Conversation with Carlyle Group, Artemis, and Fannie Mae

An Executive Summary of the Privcap Real Estate Forum in Washington D.C.

July 15, 2016More -

The Five New Rules of Hedge Fund IR

Experts from RSM, Sprott Asset Management and AlphaParity discuss the new reality for hedge fund managers looking to raise capital in an increasingly competitive world.

May 20, 2016More -

Valuation Trends in Private Equity

An executive summary on the Privcap thought-leadership series on company valuation.

Featured experts:

Richard Brekka, Second Alpha Partners Max Wolff, Manhattan Venture Partners Chris LaDue, RSM Kevin Vannucci, RSM

Key Findings:

1. With valuation policies, the more robust and transparent, the better 2. A robust strategy helps GPs defend against second-guessing 3. “Calibration” is increasingly…

April 21, 2016More -

The Realities of Repositioning Real Estate

An executive summary of the PrivcapRE video series “Real Estate Transformation and Value-Add Investing”

April 15, 2016More -

Healthcare Game Change 2015 Conference Report

This briefing is a compilation of the thought leadership on display at the Healthcare Game Change event.

March 11, 2016More -

Finding Value in a Difficult Energy Market

From the Privcap webinar “Energy, Volatility, and Valuations.”

February 26, 2016More -

Trends in Consumer Spending

A look at macro trends in consumer retail spending, featuring experts from Bain Capital and RSM.

December 7, 2015More -

Five Factors Driving The Hospitality Sector

An executive summary of the PrivcapRE video series “Investing in Hospitality Real Estate,” featuring experts from RSM, Noble Investment Group, and Fulcrum Hospitality.

November 23, 2015More -

Preparedness Is Key In Cybersecurity

Staying ahead of cyber-threats with information on the latest hacking tools is one way to avoid a data breach, says Andy Obuchowski from RSM.

October 27, 2015More -

Investment Excellence Compendium

This report, produced in partnership with RSM, taps into PrivcapRE’s extensive network of experts who provide comprehensive intelligence on the issues facing dealmakers, investors, and advisors as they confront the challenge of finding relative value in highly competitive property markets.

September 28, 2015More -

PrivcapRE Presents: Jason Kern of LaSalle

PrivcapRE editor Zoe Hughes spoke with Jason Kern, CEO of the Americas at LaSalle Investment Management, about the weight of foreign capital targeting U.S. property markets, and how investors and managers need to avoid chasing yields into lower-quality markets.

July 20, 2015More -

Investing In Office Transformation

Demographics and the changing nature of work environments have already led to a transformation in real estate investment in the office sector, with closer quarters, open-plan offices, and more creative spaces. However, experts from RSM and Cornerstone Real Estate Advisers argue that the suburbs and exurban core are also staged for a commercial real estate…

June 29, 2015More -

Carve-out Fundamentals

Three experts discuss the intricacies of separating a piece of a company from its parent, and roadblocks that can occur.

June 15, 2015More -

The New Due Diligence

In this Privcap report, RSM’s Daimon Geopfert delves into what every GP should know about cybersecurity, both at the fund level and at the portfolio company level, with additional insights from experts at Akin Gump Strauss Hauer & Feld LLP and cybersecurity firm Larson Security.

May 29, 2015More -

The Economics of U.S. Energy

The dramatic drop in oil prices is having a ripple effect across the economy, creating significant opportunities for middle-market private equity firms. John Breckenridge of Capital Dynamics and Joe Brusuelas of RSM discuss the winners and losers in the current environment, and the impact of the coming “tsunami” of capital.

April 27, 2015More -

New Rules of Dealmaking

Three experts talk sourcing and underwriting in today’s competitive markets, and what makes a successful transaction.

March 10, 2015More -

Anatomy of a PE Deal

A discussion of the relationship between Arsenal Capital Partners and its portfolio company Chromaflo.

February 10, 2015More -

2015 Operating Partners Yearbook

A roundup of thought leadership about private equity portfolio operations

December 2, 2014More -

Protecting Financial Data

RSM’s director of security and privacy for the Northeast, Keith Swiat, explains the dangers of cybercriminals and how easily they can acquire credit card and personal information if basic cybersecurity measures are ignored.

October 6, 2015More -

Buy and Builds Done Right

Experts discuss successful buy-and-build strategies, different sourcing techniques to find add-ons, and how some industries lend themselves to a buy-and-build while others do not.

September 14, 2015More -

Valuation Methods for Private Equity Assets

An Executive Summary of the Privcap Thought Leadership Series Valuations in Private Equity

August 18, 2014More -

Private Equity and Tax Policy

An executive summary of the Privcap thought leadership series Taxes and Private Equity. In partnership with RSM.

May 14, 2014More -

Excellence in Private Equity Valuations

An executive summary of the Privcap thought-leadership series “Excellence in Private Equity Valuations” In partnership with RSM.

December 18, 2013More -

Food and Beverage: Hungry for Growth

An executive summary of Privcap’s thought-leadership series on private equity investing in the food and beverage industry.

November 20, 2013More

Articles

-

How to Add ESG to a Private Equity Program

Two responsible-investment and compliance experts discuss the growing trend for GPs to launch environmental, social and governance (ESG) initiatives.

April 16, 2019More -

Hackers Eye U.S. Oil and Gas Infrastructure

A cybersecurity expert from RSM discusses the looming technological threats against energy infrastructural assets, and how middle-market firms and energy companies can take preventative measures.

September 14, 2018More -

Powerhouses in Private Equity: Howard Morgan of Argand Partners

RSM’s Don Lipari interviews Howard Morgan, co-founder of Argand Partners.

April 30, 2018More -

Powerhouses in Private Equity: Howard Newman of Pine Brook Partners

RSM’s Don Lipari Interviews Howard Newman, Chairman & CEO of Pine Brook Partners.

March 12, 2018More -

A Sleeper Hit: Terrence Mullen of Arsenal Capital Partners

Don Lipari of RSM interviews Terrence Mullen of Arsenal Capital Partners to discuss how his firm leverages innovation and creates value.

October 27, 2017More -

Powerhouses in Private Equity: Tom Lister of Permira

Lister recalls two points of investing philosophy that served Forstmann Little well.

July 18, 2017More -

Powerhouses in Private Equity: Stewart Kohl of The Riverside Company

RSM office managing partner and national private equity leader Don Lipari interviews The Riverside Company Co-CEO Stewart Kohl.

February 15, 2017More -

Power Brokers: Rodney Cohen of the Carlyle Group

Carlyle Group managing director Rodney Cohen on what he has to do to get deals done.

October 14, 2016More -

Powerhouses in PE: Geoff Rehnert

RSM’s Don Lipari sat down with Geoff Rehnert, co-CEO and co-founder of Audax Group, to discuss deal flow and valuations.

July 29, 2016More -

Software, Life Sciences Face Sweeping Accounting Changes

A recent RSM expert webinar identified industries that will be hit hardest by new revenue-recognition rules.

May 17, 2018More -

Expert Q&A: The Revenue Recognition Standard – Why it Matters

What your PE firm needs to know about the impact of this change

March 30, 2018More -

The ‘Stunning’ North American Energy Network

Privcap interviews Joe Brusuelas, chief economist for RSM, on how withdrawal from NAFTA could rock the global energy sector.

March 26, 2018More -

Investing in a Radically Changing Industrial Landscape

Michael Brennan of Brennan Investment Group LLC surveys the dramatic changes in industrial investing in the U.S. and abroad, and the growing importance of technology and automation.

January 16, 2018More -

Why U.S. Energy Is Winning the Race to “Break-Even”

Joe Brusuelas and Steve Sprenger of RSM discuss the new pricing dynamics that have made the U.S. a major player in energy.

October 23, 2017More -

The Data-Driven CFO

How technology is transforming the role of today’s finance chiefs.

August 22, 2017More -

What GPs Should Know About Carried Interest and Wealth Transfer

What every private fund professional needs to know about taxes, valuation and wealth transfer.

August 22, 2017More -

The IRS Is Targeting Partnerships – Is Yours Next?

New audit rules have big implications for private equity and real estate investors.

August 2, 2017More -

The 8 Signs You Really Need IT Due Diligence

Two RSM tech management experts share the biggest IT red flags in portfolio companies.

August 1, 2017More -

Don’t Be a “Hacker Snack”: Cybersecurity Done Right

Daimon Geopfert of RSM discusses best practices of handling the inevitable in cybersecurity.

July 18, 2017More -

The European Opportunity

RSM’s Charlie Jolly discusses the fundraising environment, the state of AIFMD, and the continent’s unique value proposition.

July 19, 2016More -

How to Build a Cybersecurity ‘Threat Model’ for PE

By performing a fund-level threat assessment, a private equity firm can get a little closer to knowing the unknown enemy behind a potential breach, says RSM’s Daimon Geopfert

July 18, 2016More -

Expert Q&A with John McCourt of RSM

The hospitality sector is going to extraordinary lengths to target millennials and attract them to key hotel brands, but will those efforts succeed in the long term?

July 16, 2016More -

Are You Making This Huge Due Diligence Mistake?

Failing to conduct IT due diligence can make or break your investment strategy warns Dave Noonan and Jonathan Caforio of RSM US LLP

March 24, 2016More