-

Uncategorized

Europe Set For ‘Liquidity Tsunami’

Europe’s core markets are set to experience a “liquidity tsunami,” but the opportunity could be gone within two years, says M7 Real Estate CEO Richard Croft.

February 23, 2015More -

Uncategorized

The State of Market Terms for Fees

Three experts discuss the current state of fees: points of negotiation, impacts of the growing expense of being a GP, and incentives offered to cornerstone investors.

February 17, 2015More -

Uncategorized

The Healthcare Private Equity Opportunity

Learn how private equity firms are partnering with healthcare innovators to build value in a rapidly changing market.

February 3, 2015More -

Uncategorized

Global Property Market Outlook 2015

LaSalle Investment Management’s Jacques Gordon tells PrivcapRE how he expects global property markets to perform in 2015.

January 19, 2015More -

Uncategorized

Why Baird Backed Integrated Diagnostics

An in-depth discussion among three experts about the dynamics between a private equity firm and their portfolio companies.

January 12, 2015More -

Uncategorized

Energy Opportunities in Latin America

Three experts on the Pacific Alliance trade bloc discuss the opportunities for private equity investment in member countries’ energy sectors.

January 5, 2015More -

Uncategorized

The Evolution of Mexican And Colombian PE

Experts on the Colombian and Mexican private equity space describe their markets’ evolution and the outlook for Latin American PE as the market matures.

December 29, 2014More -

Uncategorized

How To Play The U.S. Housing Recovery

The U.S. housing recovery played out differently to GTIS Partners’ post-crisis expectations, but CIO Tom Shapiro says the firm remains an active investor in raw lots, finished lots and home building.

December 29, 2014More -

Uncategorized

LPs To Make ‘A Lot Of Money’ In Brazil

Institutional investors will make ‘a lot of money’ on Brazil real estate in 2015 and 2016, according to GTIS Partners’ Tom Shapiro whose firm is eyeing equity investments of $100M to $500M apiece.

December 29, 2014More -

Uncategorized

Dissecting the PE Real Estate Fund Model

Property Funds Research’s Andrew Baum explains why the PE real estate fund model has fundamentally changed the role of property in investment portfolios.

December 22, 2014More -

Uncategorized

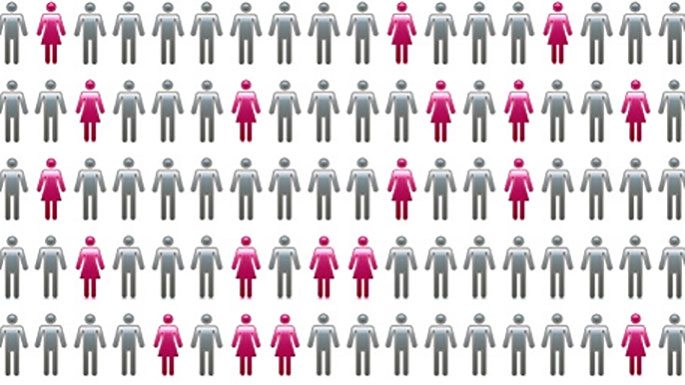

Bridging the Gender Gap in PE and VC

Watch the playback from our webinar!

December 19, 2014More -

Uncategorized

Fact: GPs Hold LP’s Investments Longer

Three experts discuss why it takes twice as long for LPs to get their money back from GPs as in the past, what this does to LP-GP relationships, and its impact on return profiles.

December 15, 2014More -

Uncategorized

Why Chromaflo Chose Arsenal

Arsenal Capital Partners’ Tim Zappala, Chromaflo’s Scott Becker and RSM’s Mauro Bonugli discuss how Arsenal came to invest in Chromaflo.

December 15, 2014More -

Uncategorized

Retail Real Estate: Prepare For Pain

Real estate investors should prepare for painful attrition and “a lot of damage” in the retail industry, as the industry shifts to online sales and smaller stores.

December 15, 2014More -

Uncategorized

How 3D Printing Will Transform RE Investing

3D printing is set to transform the way retailers sell their, severely impacting demand for real estate, how inventory is stored and product distribution.

December 15, 2014More -

Uncategorized

Why Sharing Portfolio Data Is so Difficult

Three experts explain why sharing PE portfolio data is so challenging, and what resources are necessary to do useful things with “big data” from the asset class.

December 8, 2014More -

Uncategorized

Being A Fund LP Costs You 3% On Net Returns

Being an investor in a private equity or private equity real estate fund could cost you three percent in annual net returns, says to CEM Benchmarking.

December 8, 2014More -

Uncategorized

Chris Meyn, Gavea Investmentos

Descreva como um mercado de IPOs mais lento pode implicar no dealflow em private equity.

December 5, 2014More