-

Real Estate

Growing Cornerstone’s Debt Platform in Europe and Asia

Cornerstone Real Estate Advisors’ Robert Little talks about the firm’s expansion plans in Europe, moving from core, fixed rate products into higher-yielding loans and ambitions for Asia.

May 12, 2014More -

Real Estate

Investing Beyond Brazil

Jim Worms of Paladin Realty discusses Latin American real estate opportunities in smaller countries beyond Brazil.

May 7, 2014More -

Real Estate

Rise of Students and Seniors

Demographic trends are supporting growth in “alternative” commercial property markets, like student housing, medical offices and seniors’ accommodation, says Harrison Street Real Estate Capital’s Chris Merrill.

May 5, 2014More -

Real Estate

Harrison Street’s Evolution

Chris Merrill of Harrison Street Real Estate Capital tells Privcap about the property investment group’s strategy, where he sees market opportunities and how they had to build the company to run an open-ended core fund.

May 5, 2014More -

Real Estate

Deutsche Asset Eyes Regional Opportunistic Fund

Todd Henderson of Deutsche Asset & Wealth Management, talks about the firm’s $12bn of capital inflows in 2013, tailoring opportunistic separate accounts for investors and plans for future funds.

April 30, 2014More -

Real Estate

Brazil’s Real Estate Evolution

Jim Worms of Paladin Realty delves into changes in Brazil’s real estate market in the past 15 years, financing, the state of the housing market, and challenges of building affordable housing.

April 29, 2014More -

Real Estate

A Hospitality Comeback

Hospitality has bounced back from recent lows, says Tyler Morse of MCR Development.

April 28, 2014More -

Real Estate

The Last Shall Be First: The Value of B-piece Debt

Being last in line doesn’t always mean getting the worst seats. Buyers of the most subordinated tranche of a commercial mortgage-backed securities deal, for example, get a front-row view of the debt they hold, and those seats have become increasingly valuable.

April 23, 2014More -

Real Estate

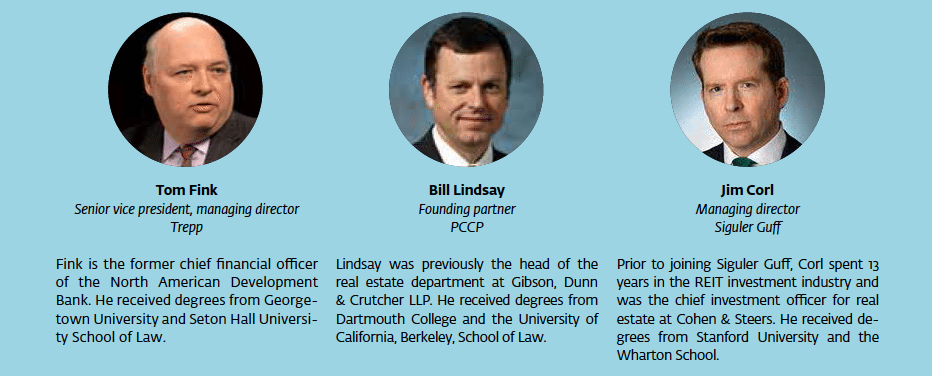

Threats and Opportunities in Debt Investing

Three experts give PrivcapRE their thoughts on the state of commercial RE debt investing as asset values continue to improve, yields tighten, and rising interest rates loom

April 23, 2014More -

Real Estate

Debt Investors, Prepare for Disappointment

The U.S. real estate debt market is overfunded and mispriced, says CMBS market pioneer Ethan Penner, with better opportunities in Europe

April 23, 2014More -

Real Estate

How Far Will You Go?

Compressing yields and a rising number of RE debt players have led to fears that the debt opportunity is over. The real issue is how far managers will go to hit their target returns.

April 23, 2014More -

Real Estate

The Third-Inning Stretch for Legacy CMBS

There are opportunities in commercial real estate debt, particularly vintages, Robert Lieber of C-III Capital Partners tells PrivcapRE

April 23, 2014More -

Real Estate

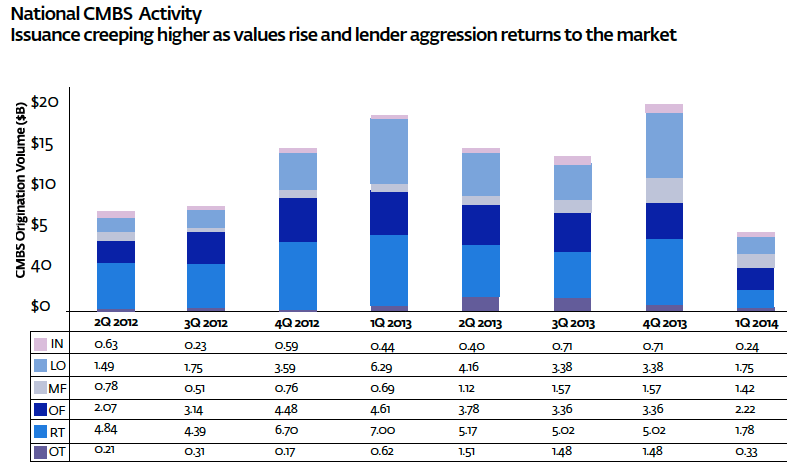

CRE Debt in Equilibrium as World Eyes U.S. Opportunity

The U.S. real estate market is at the top of the list for the world’s investors, as a rate roller-coaster ride could stabilize in the coming year.

April 23, 2014More -

Real Estate

Opportunities in Legacy CMBS Bonds

Robert Lieber of C-III Partners says the firm is focused on CMBS legacy trust bonds and sees liquidity—and opportunity—coming back to the b-piece market.

April 23, 2014More -

Real Estate

Considerable Lender Appetite for Core Debt

Cornerstone Real Estate Adviser’s Robert Little argues there will be considerable appetite for core debt, not least as some insurance companies look to double their 2013 lending volumes.

April 23, 2014More -

Real Estate

U.S. Debt Markets: Overfunded and Mispriced

The U.S. real estate debt market is overfunded and mispriced, according to former CBRE Capital Partners president Ethan Penner.

April 23, 2014More -

Real Estate

PREI: Better To Be Mezz Lender Today Than in 2010

Despite an influx of capital, opportunity remains for commercial real estate debt—if you know where to focus.

April 23, 2014More

Privcap Email Updates

Subscribe to receive email notifications whenever new talks are published.