-

Real Estate

The Shale-fueled Property Boom

North America’s increase in shale productivity is driving demand for real estate in key U.S. markets, providing private equity with another opportunity to invest in energy

July 30, 2014More -

Real Estate

Risk Premiums, Returns & Brazil

Family office GID International quantifies the risk premium it requires to invest in Brazil and India: up to 1,000bp over US development yields, says Ken Munkacy.

July 30, 2014More -

Real Estate

Real Estate: A Long-Term, Value Play

Don’t overpay for real estate, don’t over-lever and treat real estate as a long-term value play, researcher David Lynn offers his thoughts on asset allocation lessons learned.

July 30, 2014More -

Real Estate

UPS: REITs “Hands Down” Best Performer

REITs have been “hands down” the best performer for the $28 billion corporate pension, UPS. Value-added, opportunistic funds have “significantly lagged” behind.

July 23, 2014More -

Real Estate

Creating Value in a Recovering RE Market

An executive summary of the PrivcapRE thought-leadership series “Strategies for Driving Net Operating Income”

July 22, 2014More -

Real Estate

Shale Boom Flows to U.S. Property Markets

An executive at PE firm WL Ross lays out the magnitude of the increase in shale drilling productivity and how its impact extends to real estate

July 22, 2014More -

Real Estate

BlackRock: Invest Slowly, Carefully

The only way to play a recovering real estate market is “slowly, carefully, one asset at a time,” according to BlackRock global head of real estate Jack Chandler.

July 21, 2014More -

Real Estate

UPS Eyes Deal Control, JVs, Debt

Capital preservation is key for UPS’s real estate head Greg Spick. As a result, value-added and opportunistic funds are out in favor of debt, JVs and more deal control.

July 16, 2014More -

Real Estate

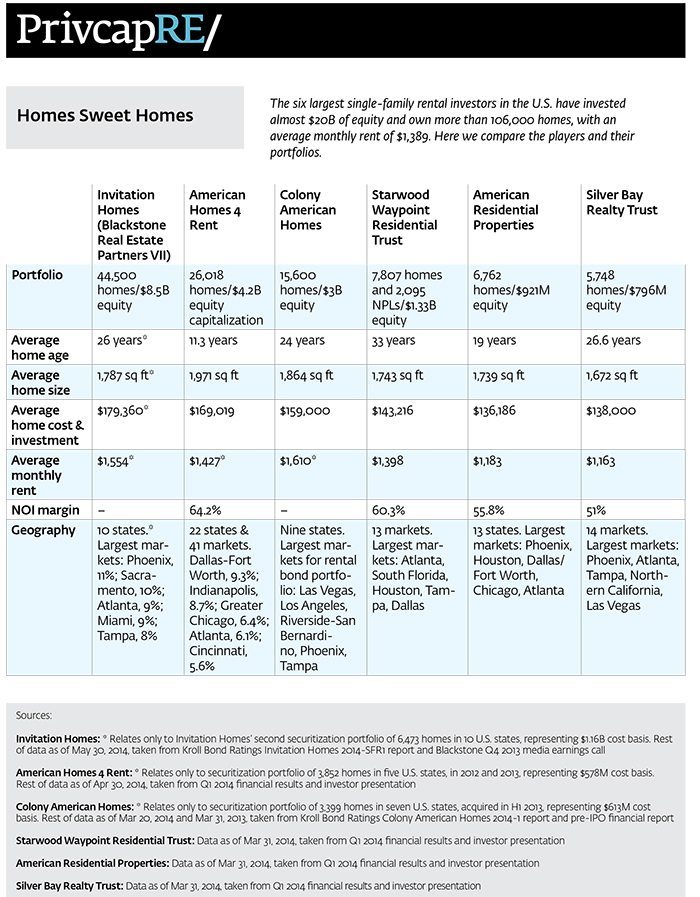

Consolidation on the Cards for Single-family Rental

Four major players could soon dominate the U.S. single-family rental industry, as the sector contemplates consolidating to fuel growth.

July 15, 2014More -

Real Estate

Multifamily Maintains Momentum as Carmel Closes $1B Fund

Carmel Partners has raised more than $1.84B for its multifamily residential funds since the financial crisis, despite a worrisome outlook for the sector

July 15, 2014More -

Real Estate

CRE Pricing Trends and Pitfalls in the U.S. & Europe

An executive summary of the PrivcapRE thought-leadership series “Understanding Real Estate Exit Strategies”

July 14, 2014More -

Real Estate

Mexico’s Emerging Listed Property Market

“You might need to time your entry, but I think today we, we find Mexico a very interesting country to invest in.”

July 9, 2014More -

Real Estate

European Capital Runs Ahead of Fundamentals

Tristan Capital’s Ric Lewis warns capital flows are running ahead of fundamentals in parts of Europe, but the region still represents best opportunity of ‘any asset class globally’.

July 8, 2014More -

Real Estate

The Most Overlooked Ways To Drive NOI

Experts from Yardi, CBRE and Taurus explore the impact on returns of reducing expenses and driving revenues, and which focus gives the biggest bang for the buck.

July 7, 2014More -

Real Estate

The Impact of Returning Liquidity In Europe

Experts from W. P. Carey, AXA Real Estate and Real Capital Analytics discuss Europe’s core and peripheral markets, new Asian investors on the scene and the likelihood of increasing bank dispositions.

June 30, 2014More -

Real Estate

Performance and Portfolio

An essential 23-page, downloadable PrivcapRE Special Report on Performance and Portfolio.

June 25, 2014More -

Real Estate

Be Happy With Second-Quartile Managers

How three LPs execute their property strategies and their plans for the asset class, how they measure performance, and what their results have been.

June 25, 2014More -

Real Estate

Building Better Returns

How Three LPs execute their property strategies and their plans for the asset class, how they measure performance, and what their results have been.

June 25, 2014More

Privcap Email Updates

Subscribe to receive email notifications whenever new talks are published.