-

Debt

The Last Shall Be First: The Value of B-piece Debt

Being last in line doesn’t always mean getting the worst seats. Buyers of the most subordinated tranche of a commercial mortgage-backed securities deal, for example, get a front-row view of the debt they hold, and those seats have become increasingly valuable.

April 23, 2014More -

Debt

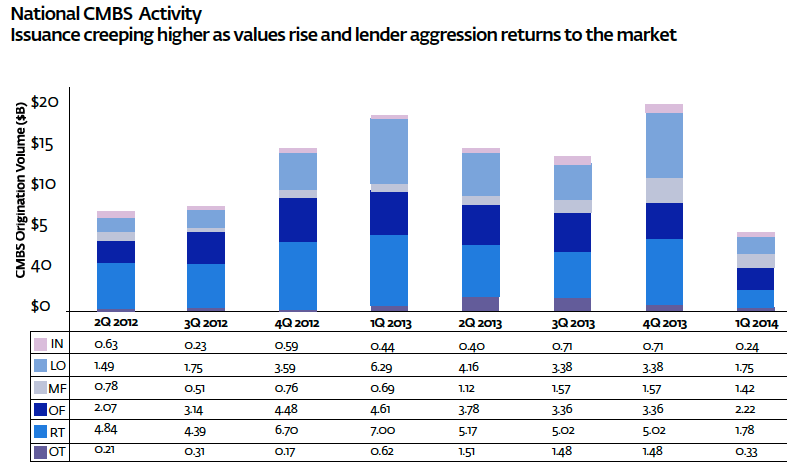

CRE Debt in Equilibrium as World Eyes U.S. Opportunity

The U.S. real estate market is at the top of the list for the world’s investors, as a rate roller-coaster ride could stabilize in the coming year.

April 23, 2014More -

Debt

How Far Will You Go?

Compressing yields and a rising number of RE debt players have led to fears that the debt opportunity is over. The real issue is how far managers will go to hit their target returns.

April 23, 2014More -

Debt

The Third-Inning Stretch for Legacy CMBS

There are opportunities in commercial real estate debt, particularly vintages, Robert Lieber of C-III Capital Partners tells PrivcapRE

April 23, 2014More -

Debt

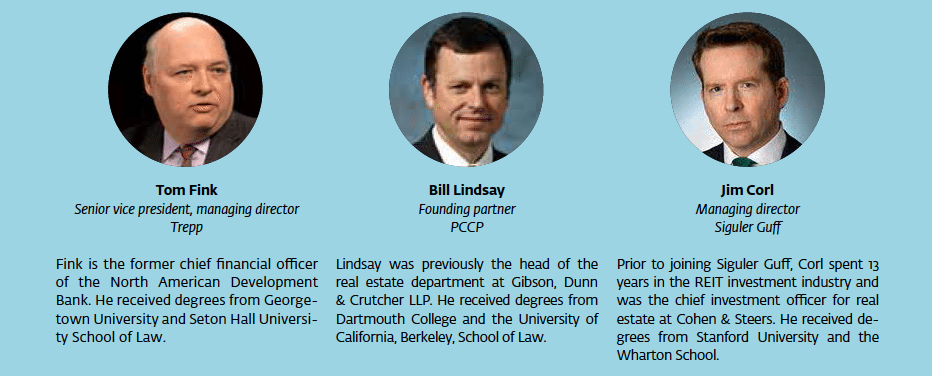

Threats and Opportunities in Debt Investing

Three experts give PrivcapRE their thoughts on the state of commercial RE debt investing as asset values continue to improve, yields tighten, and rising interest rates loom

April 23, 2014More -

Debt

Gauging Appetite: Commercial RE Debt

David Rose of Hewitt EnnisKnupp on the role of commercial real estate debt in the institutional portfolio.

February 24, 2014More -

Debt

Debt Funds: The Devil’s in the Details

LPs regained their appetite for debt funds in 2013. The outlook for the market remains strong. But the funds are not without risk.

February 24, 2014More -

Debt

The Prospects for Real Estate Debt

Talmage LLC’s Chief Executive Officer Ed Shugrue looks at what lies ahead for the real estate debt market.

February 14, 2014More -

Debt

The CRE Lender Mentality

Jeff Friedman of Mesa West Capital talks about the mentality needed to be a real estate lender.

February 12, 2014More -

Debt

Twice As Good To Be Lender Today

It’s twice as good to be a real estate lender today than at the peak of the market. Jeff Friedman of Mesa West Capital talks about the opportunities for value-added transitional loans and the challenges of borrower NOI assumptions.

February 12, 2014More -

Debt

Barrack: Europe Just Like U.S. in 2008

Europe has hit bottom. Colony Capital CEO Tom Barrack compares the real estate market in Europe to the US in 2008, but warns it’s much more difficult to hunt for deals.

November 5, 2013More