-

Debt

How ING Is Plotting Its Return to U.S. Lending

ING Finance is eyeing large-scale loans of up to $1B as it looks to regrow its U.S. lending operations, but says it will remain conservative and focused on core.

March 27, 2016More -

Debt

No Tsunami of Distress in CMBS Maturities

A strong property market and early borrower action have helped reduced the wall of CMBS maturities about to hit the U.S. commercial real estate market. However, $192B of loans still needs to be refinanced in 2016 and 2017.

January 4, 2016More -

Debt

Mezz Debt’s Steady Advance in Risk

As deals become harder to source, U.S. mezzanine debt investors and lenders are moving to secondary and tertiary markets, and taking on extra risk, to offset yield compression in the sector.

March 2, 2015More -

Debt

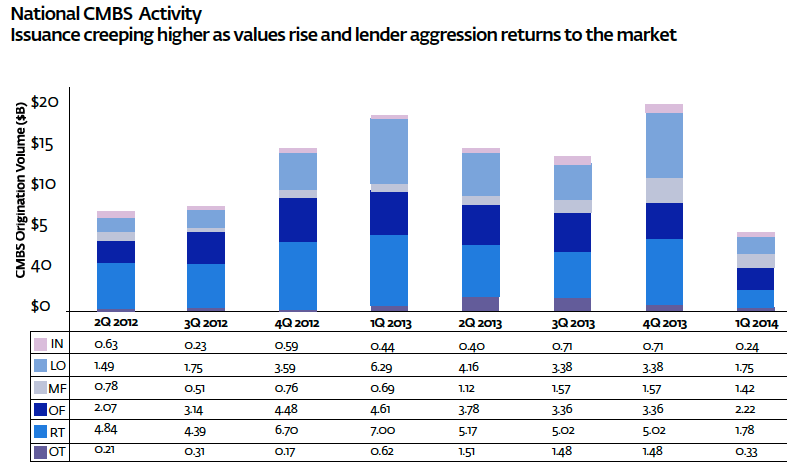

The Last Shall Be First: The Value of B-piece Debt

Being last in line doesn’t always mean getting the worst seats. Buyers of the most subordinated tranche of a commercial mortgage-backed securities deal, for example, get a front-row view of the debt they hold, and those seats have become increasingly valuable.

April 23, 2014More -

Debt

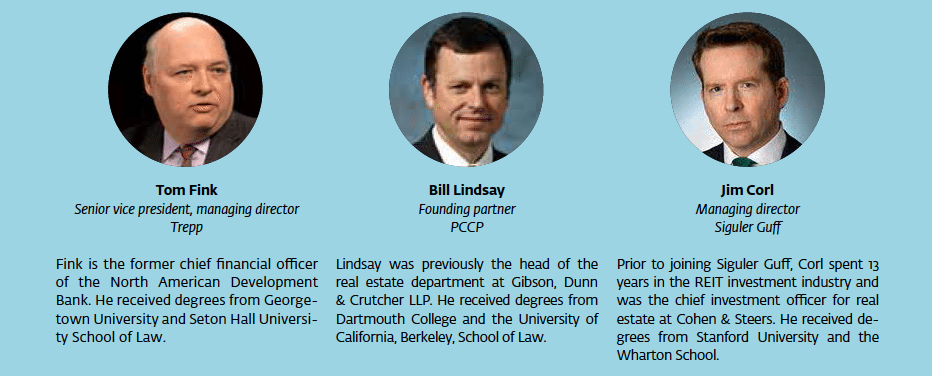

Threats and Opportunities in Debt Investing

Three experts give PrivcapRE their thoughts on the state of commercial RE debt investing as asset values continue to improve, yields tighten, and rising interest rates loom

April 23, 2014More -

Debt

The Third-Inning Stretch for Legacy CMBS

There are opportunities in commercial real estate debt, particularly vintages, Robert Lieber of C-III Capital Partners tells PrivcapRE

April 23, 2014More -

Debt

How Far Will You Go?

Compressing yields and a rising number of RE debt players have led to fears that the debt opportunity is over. The real issue is how far managers will go to hit their target returns.

April 23, 2014More -

Debt

Debt Funds: The Devil’s in the Details

LPs regained their appetite for debt funds in 2013. The outlook for the market remains strong. But the funds are not without risk.

February 24, 2014More