-

Fundraising & Performance

Being A Fund LP Costs You 3% On Net Returns

Being an investor in a private equity or private equity real estate fund could cost you three percent in annual net returns, says to CEM Benchmarking.

December 8, 2014More -

Fundraising & Performance

Fact: Fundraising Isn’t Easy

Three experts discuss why PE fundraising isn’t easy—and perhaps never has been—and why that’s a good thing.

December 1, 2014More -

Fundraising & Performance

Consulting on Foundation & Endowment Investing

Colonial Consulting’s Brian Crawford explains how they customize their approach for each foundation and endowment client and portfolio, and where to look out for risks.

December 1, 2014More -

Fundraising & Performance

Special Report: Endowments

Privcap talks to leaders from the field of endowment investing, revealing insights into how they approach the private equity and venture capital asset class. A must-read for professionals who want to know how to think like an endowment or foundation investor.

November 17, 2014More -

Fundraising & Performance

Princeton’s Approach to Endowment Investing

Princeton University Investment Company’s Jim Millar discusses the school’s approach to endowment investing

November 17, 2014More -

Fundraising & Performance

Tulane’s Portfolio Transition

Richard Chau of Tulane University’s endowment discusses why they moved to direct investing in PE, and how they get attention alongside larger investors.

November 17, 2014More -

Fundraising & Performance

Fact: PE Deals Outnumber Exits

Experts from BlackRock, W Capital, and Gen II discuss the impact of three new deals for every exit.

November 13, 2014More -

Fundraising & Performance

Does More Data Lead to Smarter Investing?

Does better data equal better decisions for private equity LPs? Experts from AlpInvest, Siguler Guff and Clayton, Dubilier & Rice discuss.

November 10, 2014More -

Fundraising & Performance

How Operations Experts Enhance Deal Sourcing

Operating partners lend expertise to deal sourcing in two main ways, says RSM’s Mauro Bonugli: developing investment theses and tapping into their networks.

November 7, 2014More -

Fundraising & Performance

Changing Dynamics of LP-GP Contact

The nature and frequency of how LPs contact GPs is evolving, says Mounir Guen of MVision Private Equity Advisers.

November 3, 2014More -

Fundraising & Performance

The Voice of the LP

Thought leadership on an evolving asset class, The Voice of the LP features experts from: Zurich Alternative Asset Management, Ardian, Korea Investment Corporation, Washington University Investment Management Co., Performance Equity and MVision Private Equity Advisers. Sponsored by MVision

November 3, 2014More -

Fundraising & Performance

Entrepreneurs and Private Capital

The latest in Privcap’s series of professional development webinars, presented with EY, will explore the relationship between entrepreneurs and private capital.

October 31, 2014More -

Fundraising & Performance

Staying Calm Amid Oil Price Volatility

Jeff Eaton of Eaton Partners is urging other limited partners not to panic about investing in the oil and gas sector amid price volatility. He explains why he remains bullish on fundraising.

October 28, 2014More -

Fundraising & Performance

Riding the Data “Tsunami”

Experts from AlpInvest, Siguler Guff, and Clayton, Dubilier & Rice discuss harnessing private equity data to monitor the portfolio and vet partners.

October 27, 2014More -

Fundraising & Performance

How Important Are Individual Partners?

Prof. Michael Ewens discusses mining for data to research PE and VC, what he found in terms of performance, and whether partners matter more than firms.

October 27, 2014More -

Fundraising & Performance

Expert Q&A With Hank Boggio of iLEVEL Solutions

Hank Boggio of iLEVEL Solutions discusses the need for better information sharing in private equity.

October 27, 2014More -

Fundraising & Performance

Five Reasons Why You Won’t Raise Your Next Fund

Executive summary of the Privcap series on “Five Reasons Why You Won’t Raise Your Next Fund” with expert commentary from MVision Private Equity Advisers, StepStone Group and Zurich Alternative Asset Management.

October 20, 2014More -

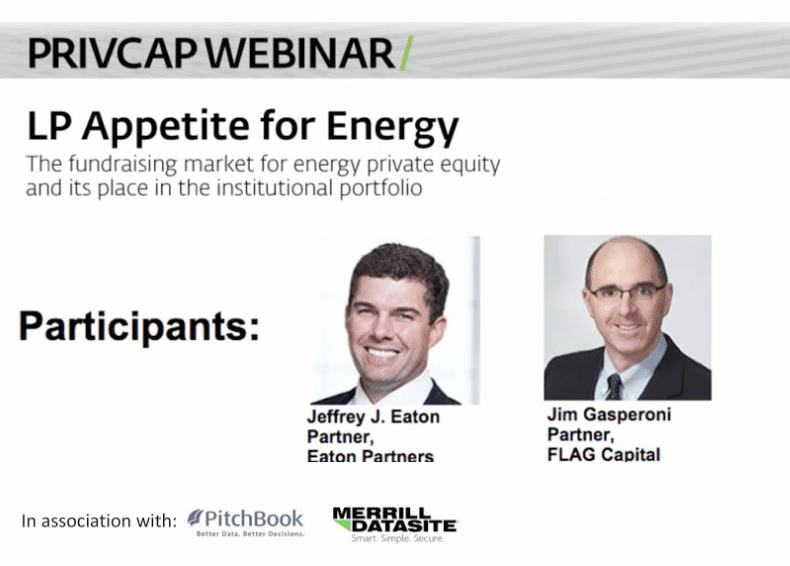

Fundraising & Performance

LP Appetite for Energy

Energy and energy-related strategies are becoming among the largest allocations within institutional private equity portfolios. What does this mean for GPs planning their next fundraising? Find out in this playback of our 45-minute webinar, moderated by Privcap Media CEO David Snow.

October 17, 2014More