-

Fundraising & Performance

PPM Smackdown: PebbleOak Capital

This episode: PebbleOak Capital Partners – Big Win, Big Wipeout

February 24, 2015More -

Fundraising & Performance

Mapping a Vast Fundraising Landscape

Three fundraising experts give an introduction to the vastness and importance of fundraising in the U.S. market, particularly for non-U.S. GPs seeking to grow.

February 23, 2015More -

Fundraising & Performance

The State of Market Terms for Fees

Three experts discuss the current state of fees: points of negotiation, impacts of the growing expense of being a GP, and incentives offered to cornerstone investors.

February 17, 2015More -

Fundraising & Performance

Healthcare’s Technology Revolution

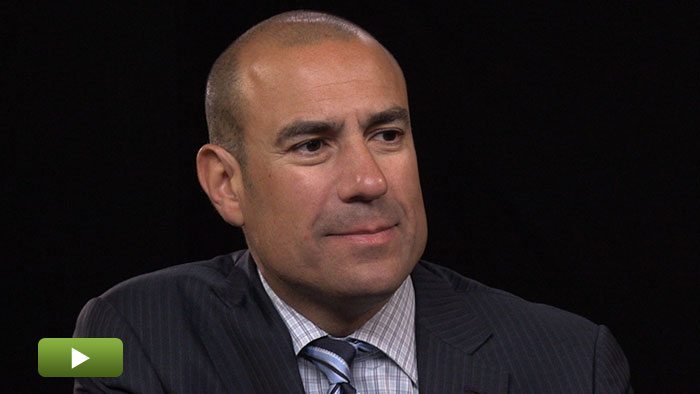

GTCR is betting on a healthcare revolution in the coming years, assembling a management team to source deals in the sector, says managing director Dean Mihas.

February 9, 2015More -

Fundraising & Performance

Scrutinizing Deal-Related Expenses

An executive summary of the Privcap video: Times Have Changed for Deal Expenses.

February 3, 2015More -

Fundraising & Performance

General Atlantic’s Philanthropic Start

General Atlantic’s Jonathan Korngold tells Privcap about how the growth capital firm has morphed from its philanthropic beginnings.

February 2, 2015More -

Fundraising & Performance

Z Capital’s Unique Approach to Deal Sourcing

Z Capital Partners’ Jim Zenni tells Privcap about the firm’s proprietary deal sourcing system and explains its focus on companies with operational and financial issues.

February 2, 2015More -

Fundraising & Performance

How GTCR’s Leadership Strategy Built Devicor

GTCR’s Dean Mihas tells Privcap about his firm’s exit of medical-devices business Devicor and how “The Leadership Strategy” was used to build the portfolio company.

January 19, 2015More -

Fundraising & Performance

Times Have Changed for Deal Expenses

Anne Anquillare of PEF Services and Julia Corelli of Pepper Hamilton discuss how to figure out who should pay for what fees and expenses associated with a PE firm.

January 19, 2015More -

Fundraising & Performance

Four Facts About the State of PE

An executive summary of Privcap Series: The PE Data Tsunami

January 9, 2015More -

Fundraising & Performance

Dissecting the PE Real Estate Fund Model

Property Funds Research’s Andrew Baum explains why the PE real estate fund model has fundamentally changed the role of property in investment portfolios.

December 22, 2014More -

Fundraising & Performance

North American PE Energy Funds Hit Peak in 2014

In 2014, there were the most North American PE energy-focused funds in the market since 2005, according to PitchBook data. Privcap asked Jeff Eaton of Eaton Partners about the fundraising environment in 2014 and what’s ahead for 2015.

December 17, 2014More -

Fundraising & Performance

Inside Carlyle’s Middle-Market Group

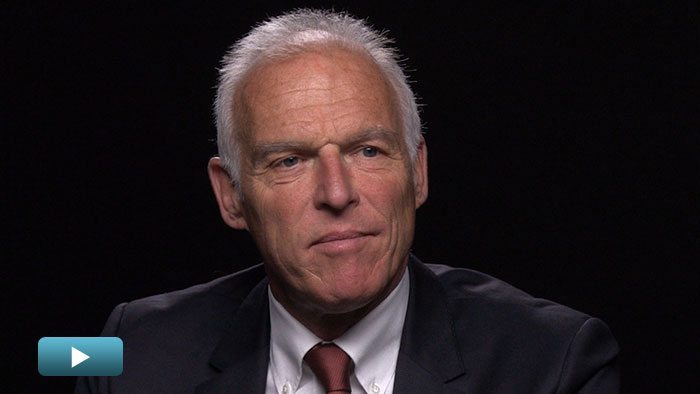

The Carlyle Group’s Rodney Cohen tells Privcap how the firm’s sub-group for middle-market investments operates, and how they source and win deals.

December 15, 2014More -

Fundraising & Performance

Fact: GPs Hold LP’s Investments Longer

Three experts discuss why it takes twice as long for LPs to get their money back from GPs as in the past, what this does to LP-GP relationships, and its impact on return profiles.

December 15, 2014More -

Fundraising & Performance

Why Chromaflo Chose Arsenal

Arsenal Capital Partners’ Tim Zappala, Chromaflo’s Scott Becker and RSM’s Mauro Bonugli discuss how Arsenal came to invest in Chromaflo.

December 15, 2014More -

Fundraising & Performance

The PE Data Tsunami

An executive summary of Privcap Series: The PE Data Tsunami

December 15, 2014More -

Fundraising & Performance

Baird’s New Products Operating Partner

Privcap speaks to Scott Hoffman about why he joined the private equity firm after a 28-year career in industrial products

After spending nearly three decades at an industrial products company, including running four global businesses, Scott Hoffman made the leap to private equity operating partner.

It was an easy decision for him to move to…

December 9, 2014More -

Fundraising & Performance

Why Sharing Portfolio Data Is so Difficult

Three experts explain why sharing PE portfolio data is so challenging, and what resources are necessary to do useful things with “big data” from the asset class.

December 8, 2014More