-

Energy & Real Assets

Mexican Energy, the PE Opportunity

Groundbreaking regulatory changes in Mexico are opening up the market for investment in the country’s booming energy market.

August 12, 2014More -

Energy & Real Assets

Inside Pine Brook’s Energy Investing

Energy is a specialty of private equity firm Pine Brook Partners. Read more!

August 5, 2014More -

Energy & Real Assets

Energy Reform Fuels Mexican Investment Opportunities

KKR: Widespread energy reforms introduced by Mexico’s President Pena Nieto are opening the market to foreign investors.

July 28, 2014More -

Energy & Real Assets

Infrastructure in Emerging Markets

A panel of experts from Pembani Remgro, IFC Global Infrastructure, and NSG Capital talk about their approaches to putting private equity capital to work in emerging market infrastructure.

July 23, 2014More -

Energy & Real Assets

Deal Stories: Emerging Markets Infrastructure

Our panel of experts from Pembani Remgro, IFC and NSG Capital tells of investments they’ve made in the infrastructure of emerging markets, and how they performed.

July 23, 2014More -

Energy & Real Assets

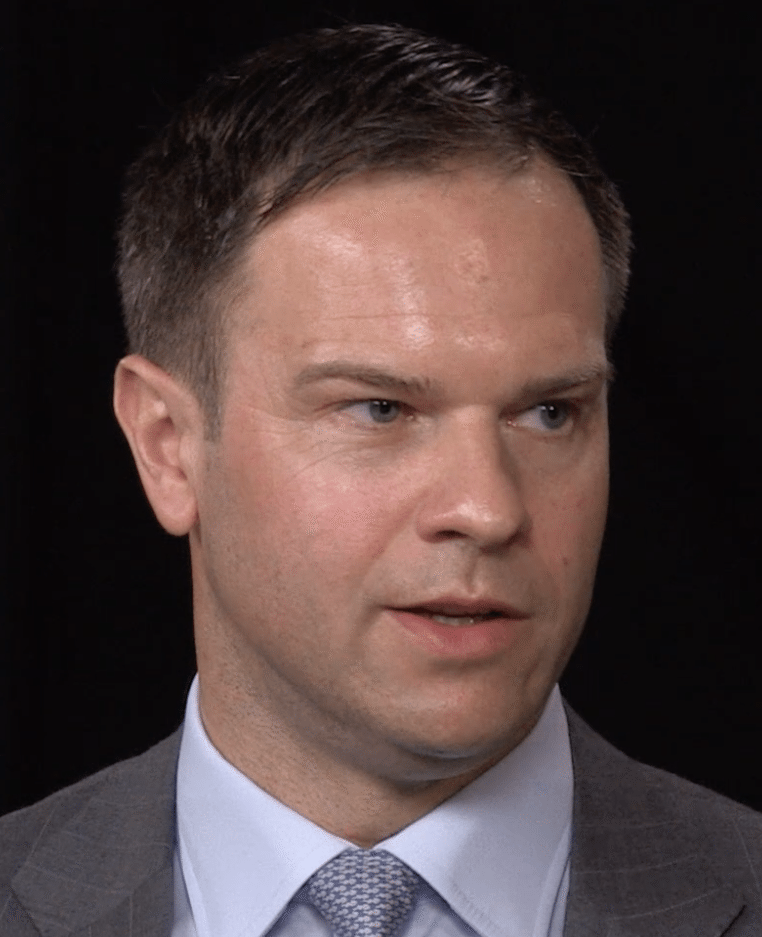

WL Ross on Upstream’s Rise

A managing director at PE firm WL Ross lays out the magnitude of the increase in shale drilling productivity and its economic impact, and discusses investing in a niche upstream energy sector.

July 22, 2014More -

Energy & Real Assets

EnerTech’s Investment Latitude

Wally Hunter of EnerTech Capital tells Privcap about investing in energy technology, particularly companies treating water at oil-and-gas sites.

July 15, 2014More -

Energy & Real Assets

GE Canada’s New Approach to Venture Capital

GE Canada has transformed the way they deal with venture capital.

July 9, 2014More -

Energy & Real Assets

EnCap’s Recent Fundraise: $3B in Four Months

EnCap Investments targets opportunities in the unquestionably hot midstream and upstream oil and gas sector. Chuck Bauer, the firm’s head of IR, tells Privcap about its latest fundraising—a $3B midstream fund that hit its hard cap in four months.

June 24, 2014More -

Energy & Real Assets

The Energy Opportunity

Report on putting private capital to work in a transformed North American oil & gas market

June 10, 2014More -

Energy & Real Assets

Undefeated: Energy PE Funds

In the long term, energy funds on average have outperformed most equity and debt indices

June 10, 2014More -

Energy & Real Assets

The North American Energy Revolution

Privcap takes a closer look at the shifting dynamics of the booming oil and gas sector

June 10, 2014More -

Energy & Real Assets

U.S. Energy Needs More Private Equity

Private equity is transforming the oil and gas landscape. Meanwhile, capital-intensive energy investing is transforming private equity.

June 10, 2014More -

Energy & Real Assets

PE Fights MLPs in Midstream Opportunity

Riverstone: PE can compete with MLPs in midstream energy opportunity. Free with Privcap registration.

June 10, 2014More -

Energy & Real Assets

Wanted: Solid Energy Operators

Private equity firms looking to take advantage of the North American energy opportunity are facing a shortage of operating team talent, says an expert panel.

June 10, 2014More -

Energy & Real Assets

How Innovation Shaped PE’s Energy Boom

An expert panel talks about how the energy opportunity for PE has changed in the past decade, and what risks could be lurking ahead.

June 10, 2014More -

Energy & Real Assets

How Energy GPs Build Platforms

How private equity firms inject capital into oil and gas deals in multiple stages.

June 10, 2014More -

Energy & Real Assets

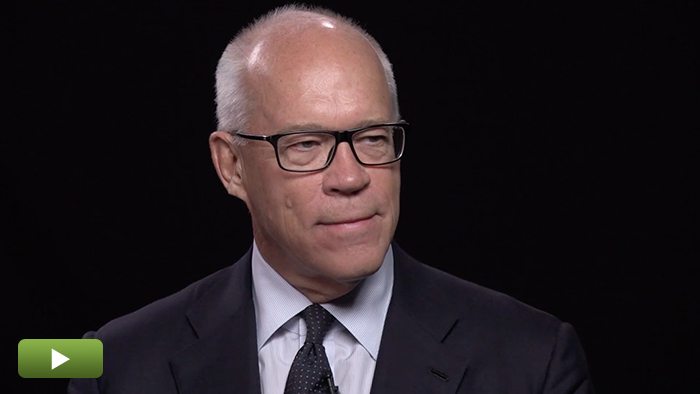

The Story of Riverstone

Riverstone began after co-founders Pierre Lapeyre and David Leuschen met at Goldman Sachs. They decided the focus of their firm should be more on energy, less on private equity.

June 10, 2014More