-

Dealmaker

Winners and Losers in the COVID-era Food and Beverage Industry

The domination of big brands in the COVID era and the degree to which consumer behavior has permanently changed as a result of the crisis.

September 15, 2020More -

Dealmaker

Private Credit in the Institutional Portfolio

Two veterans of private credit discuss reasons why institutional investors should allocate to the asset class, how to build a diversified portfolio, and credit performance amid the COVID crisis.

September 8, 2020More -

Dealmaker

Food and Beverage Direct-to-Consumer Model Gets Second Wind

A conversation with three industry deal veterans

September 4, 2020More -

Dealmaker

Winners and Losers in the COVID-Era Food and Beverage Industry

Part of Privcap’s quarterly Dealmaker series. Three food and beverage deal experts discuss the domination of big brands in the COVID era, the importance of supply chains, innovations in protein, and the degree to which consumer behavior has permanently changed as a result of the crisis.

September 4, 2020More -

Dealmaker

A Distressed Investor Surveys the Damage

Rodney Cohen, Head of Private Equity at Black Diamond Capital Management, talks about which sectors he finds interesting amid the downturn, and which sectors he is likely to avoid.

September 3, 2020More -

Dealmaker

Anatomy of a Pandemic Downturn

Having co-led the middle-market private equity business of The Carlyle Group, Rodney Cohen recently joined Connecticut-based Black Diamond Capital Management to lead the firm’s distressed-for-control business. In a wide-ranging conversation with RSM’s Don Lipari, Cohen describes his transition to Black Diamond, the firm’s approach to investing, and the right way of thinking about the “real…

September 3, 2020More -

Dealmaker

State of the 2020 Private Equity Secondaries Opportunity

A lively discussion among PE secondaries experts on the storm of market factors precipitating rapid change among this asset class. Topics will include:

The growth of the secondaries asset class and severity of the COVID disruptionDue diligence in a remote environmentPremium/discount-to-NAV trendsThe rise of GP-solution secondaries and continuation funds

To learn more about where LPs…

August 12, 2020More -

Dealmaker

Fund Financing Amid COVID-19

Experts from Wells Fargo, Mizuho Securities and Haynes and Boone discuss the current state of the fund financing market for private capital, including the impact on GPs, LPs and lenders.

August 7, 2020More -

Dealmaker

Dealmaker: Chronic Change in the Healthcare Industry

Three healthcare dealmakers discuss the disruptions of COVID 19 and longer-term trends roiling the industry.

July 20, 2020More -

Dealmaker

Dealmaker: Chronic Change in the Healthcare Industry

Experts from Waterline Ventures and RSM discuss the sea change in healthcare amid COVID-19

June 23, 2020More -

Dealmaker

Sun Capital in the Eye of the Distress Storm

A Zoom interview with the founders of Sun Capital about how the firm is faring amid economic disruption.

June 8, 2020More -

Dealmaker

Cyber Hygiene: Important in Due Diligence and as a Business Model

Interview about cybersecurity with private equity veteran Rich Lawson of HGGC

May 26, 2020More -

Dealmaker

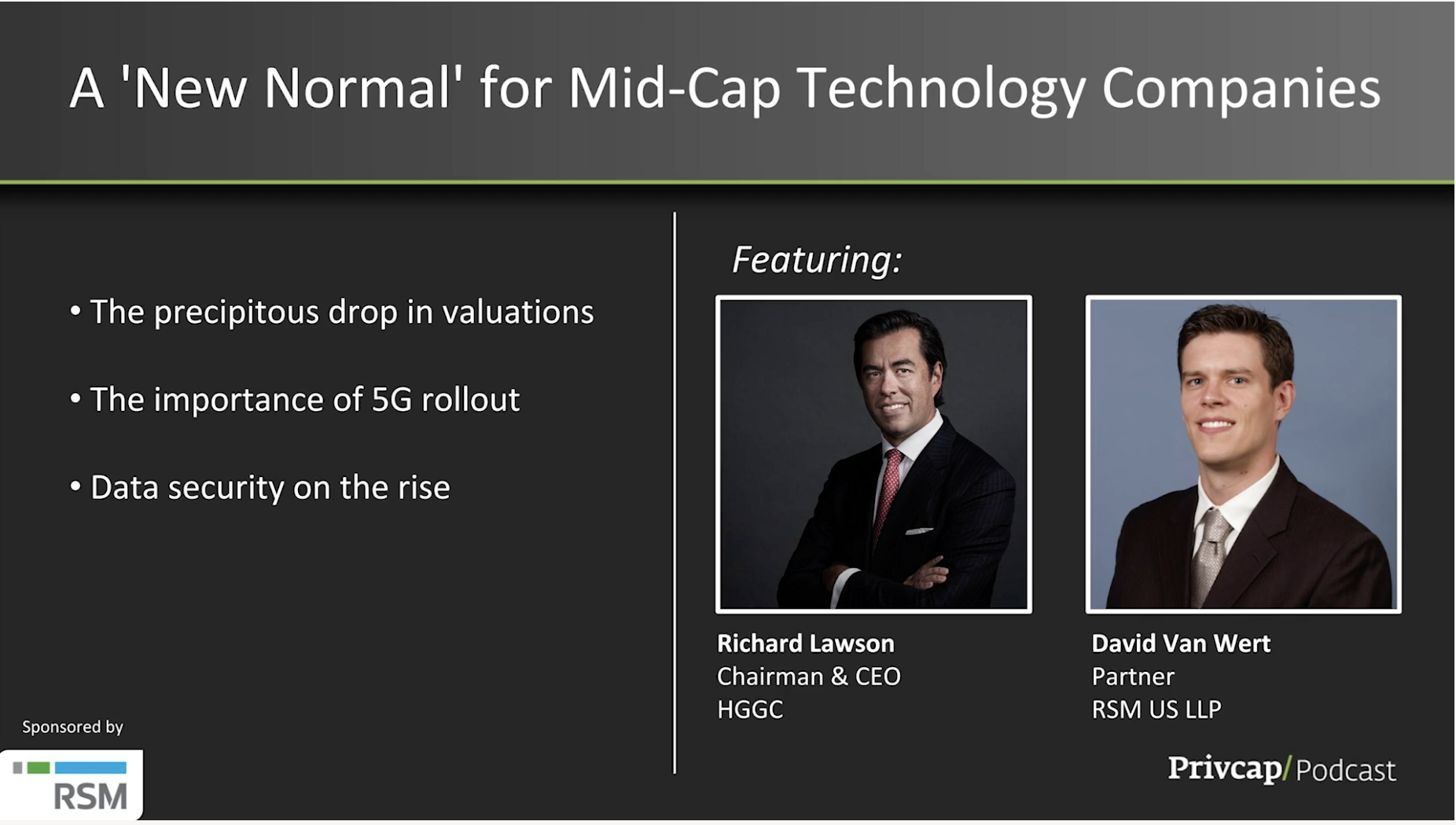

The ‘New Normal’ for Mid-Cap Technology Companies

Dropping valuations, 5G rollout and the rise of cybersecurity

May 4, 2020More -

Dealmaker

A ‘New Normal’ in Mid-Cap Technology Companies

Richard Lawson of HGGC and David Van Wert of RSM discuss the precipitous drop in valuations of technology companies, the importance of the 5G rollout, and the rise of cybersecurity as a form of due-diligence and as a business plan.

April 4, 2020More -

Dealmaker

Cannabis Investment Enters ‘Darwin Phase’

Two prominent investors in cannabis businesses compare notes.

March 30, 2020More -

Dealmaker

Tricor Pacific: A Culture of Giving Back

Rod Senft, Chairman of Vancouver-based Tricor Pacific Capital, discusses his firm’s approach to charitable giving, including support for prostate cancer work and dignity for dumpster-divers.

February 17, 2020More -

Dealmaker

Vancouver Values: Tricor Pacific’s Rod Senft

Part of Privcap’s “Powerhouses in Private Equity” interview series, Tricor Pacific Capital’s Rod Senft discusses the rise of his Vancouver-based multi-strategy firm, how he wants entrepreneurs to view him, his favorite deal, and the “joy” and “thrill” that business builders need to feel to thrive. Interview by RSM Canada’s Ben Gibbons.

February 17, 2020More -

Dealmaker

Dealmaker Q1 2020: Deep Dive into Software Deals

This edition of Dealmaker features Privcap’s curated conversation with experts from LLR Partners and RSM who have worked extensively on software transactions. As software has grown exponentially as an industry and omnipresence in society, private capital has flowed into the sector in greater and greater amounts. Why are private equity investors so eager to own…

February 11, 2020More