-

Capital Raising & IR

Strong Returns Could Continue To 2018

Returns from value-added and opportunistic real estate funds have been exceptional and could continue through 2018. But a deceleration is in the cards, says an expert PrivcapRE panel.

March 30, 2015More -

Capital Raising & IR

How to Avoid Being a Passive LP

Siguler Guff’s James Corl tells PrivcapRE about the firm’s ability to shut down a fund’s investment period and cap fund sizes.

February 16, 2015More -

Capital Raising & IR

The Untapped Middle Eastern Capital

Capital from little-known Middle Eastern institutions and family offices will increase dramatically as investors look for returns and diversification outside the region. Value-added and opportunistic strategies in the U.S. and co-investment will be favored.

January 19, 2015More -

Capital Raising & IR

How to Become a Female RE CEO

What does it take to become a female real estate CEO? Three senior executives in development and real estate private equity discuss the challenges facing women and how to overcome them.

November 10, 2014More -

Capital Raising & IR

Inside Dune’s $960M Fundraising

Raising a new fund is never easy. But the reasons a fundraising is tough can vary from fund to fund, says Cia Buckley Marakovits, partner and chief investment officer at Dune Real Estate Partners.

November 4, 2014More -

Capital Raising & IR

Euro LPs: Driving Force Of Rising Allocations

Investors are set to allocate more than €35B of new equity to real estate, but are struggling to find suitable vehicles, INREV CEO Matthias Thomas reveals.

October 14, 2014More -

Capital Raising & IR

GPs: Ignore Retail Investors At Your Peril

Real estate GPs who ignore the capital raising power of retail investors do so at their own peril, says David Lynn, author and former head of portfolio management.

August 4, 2014More -

Capital Raising & IR

Creating Value in a Recovering RE Market

An executive summary of the PrivcapRE thought-leadership series “Strategies for Driving Net Operating Income”

July 22, 2014More -

Capital Raising & IR

European Capital Runs Ahead of Fundamentals

Tristan Capital’s Ric Lewis warns capital flows are running ahead of fundamentals in parts of Europe, but the region still represents best opportunity of ‘any asset class globally’.

July 8, 2014More -

Capital Raising & IR

Benchmarking RE Funds: What Works

Experts from Cambridge, PREA and Crossroads delve into benchmarking value-added and opportunistic real estate funds – what works and what doesn’t.

June 18, 2014More -

Capital Raising & IR

Interest Rates: Real Estate’s “Biggest Risk”

Madison International Realty President and Founder Ron Dickerman on why he thinks rents are rising and higher interest rates are the biggest threat to the market today.

June 18, 2014More -

Capital Raising & IR

Renewals, Reinvestment & NOI Growth

Experts from Yardi, CBRE and Taurus discuss NOI growth in 2014, being paid a premium for vacancy and the challenge of tenant renewals for older properties.

June 10, 2014More -

Capital Raising & IR

PREA: Rising RE Allocations

PREA’s Greg MacKinnon shares findings of a global survey of RE institutional investor intentions.

May 28, 2014More -

Capital Raising & IR

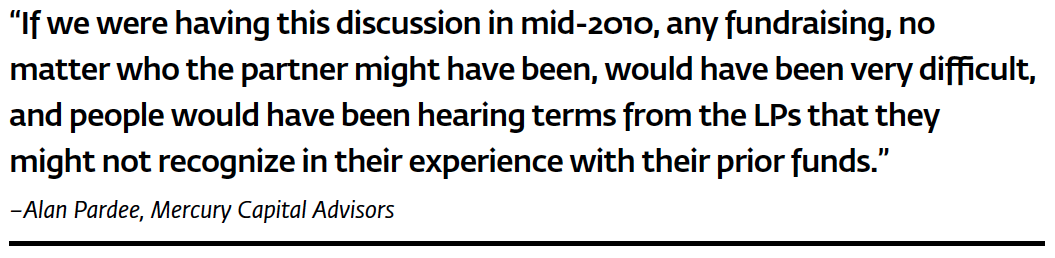

Catch-ups Carry On

GP remuneration, particularly catch-up provisions, came under fire from LPs in the wake of the financial crisis when investors gained the upper hand in negotiations. But the market has now adapted and stabilized, experts tell PrivcapRE.

May 28, 2014More -

Capital Raising & IR

History, Discipline, and Shorter Real Estate Cycles

If real estate cycles are getting shorter, what does that mean for investors in closed-ended private equity real estate funds?

May 28, 2014More -

Capital Raising & IR

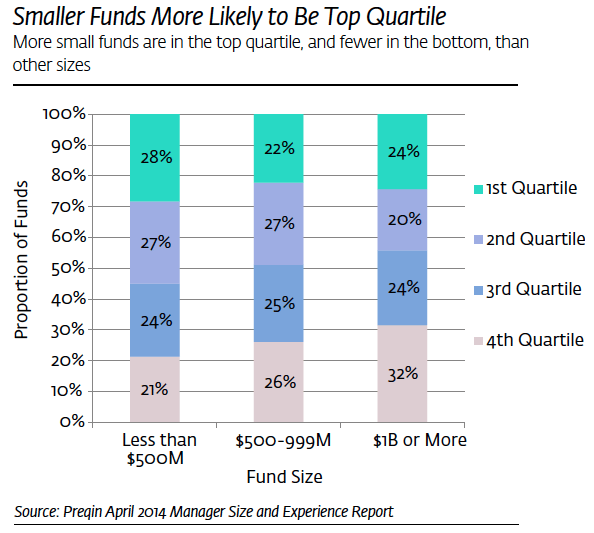

LPs and Emerging Managers in the Portfolio

Experts from the UVIMCO, United Nations, and Texas Teacher pension funds talk about support for small and emerging real estate managers, and offer advice for the next generation of GPs

May 28, 2014More -

Capital Raising & IR

The Art and Science of Real Estate Asset Allocation

There is no one right way to do it and few tools at their disposal to help them. There are, however, some important questions to ask.

May 28, 2014More -

Capital Raising & IR

ERS’s Emerging Program

The Employees Retirement System of Texas plans to build its emerging manager program to $1B by 2019.

May 28, 2014More