Q&A: Women in Private Equity

Sally Mahloudji Vogelhut, a managing director with strategic fundraising adviser MVision, is a veteran of the private equity market. In a recent interview, she described the reasons behind underrepresentation in the industry and what can be done to address it.

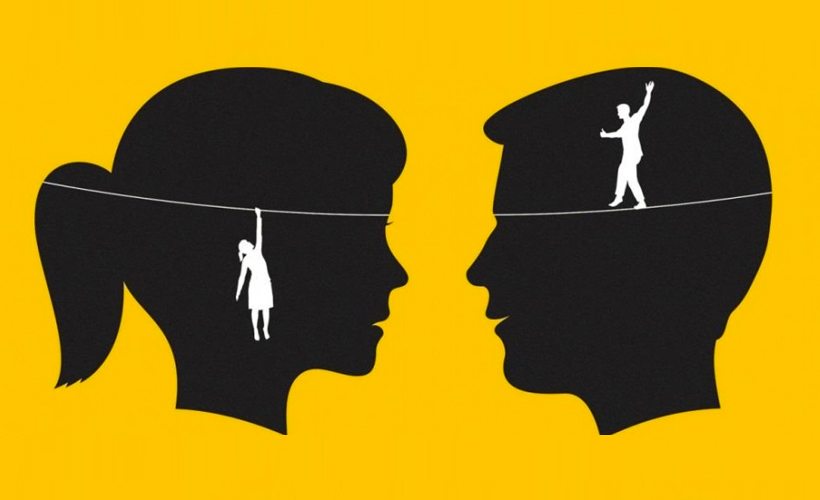

Privcap: Why are there so few women in senior positions in private equity and venture capital?

Sally Mahloudji Vogelhut, MVision: The issue is across the asset class. You see less women in senior positions, regardless of whether they are in private equity or venture capital. I think the long-term solution here is for general partners to recognize that there is an issue and there’s a need to proactively address it.

Vogelhut: It’s no surprise that there are less women in private equity, especially in senior positions. I think there are a couple of reasons why women are underrepresented in the industry. First and foremost, it really has to do with simply the origins of the industry. Many of these early general partners were founded, led and managed by men. And many of these firms have historically only recruited from investment banks and some top-tier business schools. So, you’re already starting with a pool of candidates where women are fewer.

Are LPs starting to pay attention to diversity within GP organizations?

Vogelhut: Yes, we’ve already seen many LPs—including consultants, public pensions and endowments—revise their due-diligence templates to include ways for firms to measure and record both ethnic and gender diversity.

What can firms do to proactively seek greater diversity?

Vogelhut: We’ve seen a lot of GPs become more proactive in recruiting more women to their firm. Many of the larger institutions have implemented diversity committees and their sole goal is to increase both gender and ethnic diversity in the large number of candidates they recruit each year. They’re also looking beyond the traditional avenues of recruitment. They’re looking beyond the investment banks. They’re looking at consulting firms and other graduate programs where there is a larger representation of females.

Are private equity and venture capital firms offering enough flexibility for women with small children?

Vogelhut: Deal partners have extremely demanding jobs. They have a lot to do. We are seeing more women in the roles of general counsel, IR and HR functions, because these roles allow for more flexibility. Flexibility can mean different things to different people. It can mean a job share. It can mean having two co-heads of a group so that there’s always one person on. Or it can be allowing your employees to work remotely. We have not seen deal partners fully accept flexibility as a successful working model just yet.

What do you predict for the role of women in private equity as the market continues to transform?

Vogelhut: I think we’ll continue seeing women start their own firms. We’ve definitely seen more incoming, first-time women GPs contact MVision. And I think we’ll definitely continue to see GPs understand that they need to diversify their bench for the good of their firm.

Sally Mahloudji Vogelhut of MVision describes the reasons behind underrepresentation in the industry and what can be done to address it.