The Hidden Risk in Private Equity—and How to Avoid It

The rise in pension fund allocations to alternatives comes with a big challenge.

You can’t work in private equity and not marvel at the titanic shift to alternatives among the world’s public and private pensions.

The world’s 10 largest pensions, representing more than $1.5T in assets, increased their allocation to alternatives by 10 percent from 2010 to 2013, according to an OECD survey. A recent report by Cliffwater found that state pensions in the U.S. had increased average allocation targets to alternative from 10 percent in 2006 to 24 percent in 2014.

It’s a boon for the industry, of course, but it comes with a risk that you won’t find in any financial model—I’ll call it board risk.

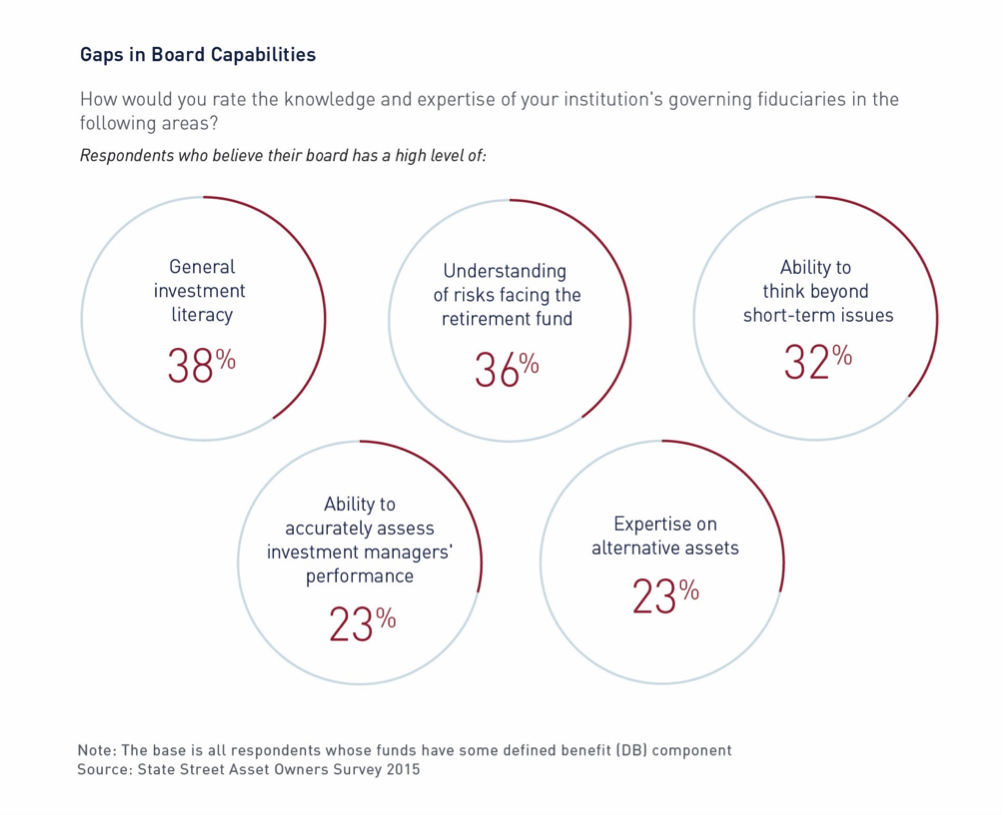

The issue is that the increase in allocation has outpaced pension boards’ understanding of the asset class. A report released last week by financial services provider State Street put it plainly—of 400 senior pension fund executives surveyed, less than a quarter of them expressed confidence that their board had a “high level” of expertise in alternative assets or an ability to “accurately assess” an investment manager’s performance.

As alternatives make up an increasing share of the pension funds net returns, the disconnect could lead to unnecessary lawsuits and, ultimately, a scaling back of the allocation altogether.

In other words, that lack of understanding of alternative assets or an investment manager’s performance means that today’s enthusiasm could quickly turn into tomorrow’s disfavor. Faced with market volatility and market cycles, will pension boards be able to understand—and therefore stomach—private equity’s illiquidity and the relatively Byzantine reporting on long-term investments?

Any significant retreat could spell doom for new managers and those whose recent track records are less than stellar, and a swift end to the management fee bonanza that has accompanied the industry’s ballooning assets under management. One could argue that the pension industry’s increasingly difficult search for yield will protect private equity from a full blown retreat, but “they don’t have another choice” is hardly a winning strategy.

The bright side—the pension fund industry appears committed to getting up to speed. The State Street survey also reported that 45 percent of respondents said they “intend to increase training and education opportunities for board members in the next year.”

All the training in the world won’t make board members happy when PE funds underperform, but it could help give them the patience to hang on when times get tough.

The rise in pension fund allocation to alternatives has outpaced a pension board’s ability to understand the asset class.