Lerner: Co-investment ‘Cure’ Worse than the Disease?

More LPs than ever want to co-invest—but should they?

If private equity co-investing came with a warning label, it might read something like this—easy to swallow, but may be hazardous to your long-term financial health.

Indeed, for the world’s institutional investors, any medicine meant to kill high management fees goes down easy. With a huge pile of cash at their disposal, why not invest in individual deals and circumvent those greedy intermediaries? What could possibly go wrong?

Quite a bit, according to Harvard Business School Prof. Josh Lerner, who discussed the perils of co-investing in a recent Privcap interview. As Lerner’s research demonstrates, it’s not that paying high management fees isn’t a drag on performance, it’s that when co-investing happens, it tends to happen in ways that are detrimental to the LP.

Namely:

- Co-investing suffers from a “lemons” problem—LPs typically can’t pick the deals they want to invest in.

- Co-investments are necessarily concentrated in big deals—GPs require more capital to close them—and big deals tend to underperform.

- Like many investments, co-investments follow the herd—deals are concentrated near market peaks.

Lerner explains:

https://privcap.wistia.com/medias/rx3kblu0hx?embedType=iframe&videoWidth=700

(Watch the full video)

Ultimately, Lerner’s study of investments by seven large institutions found that from 1994-2011, the mean return of co-investments relative to the return of the corresponding PE funds in which those deals were held was nearly nine percent less. In other words, by co-investing, LPs earned a lower overall return than if they had simply maintained their “regular” fund investment.

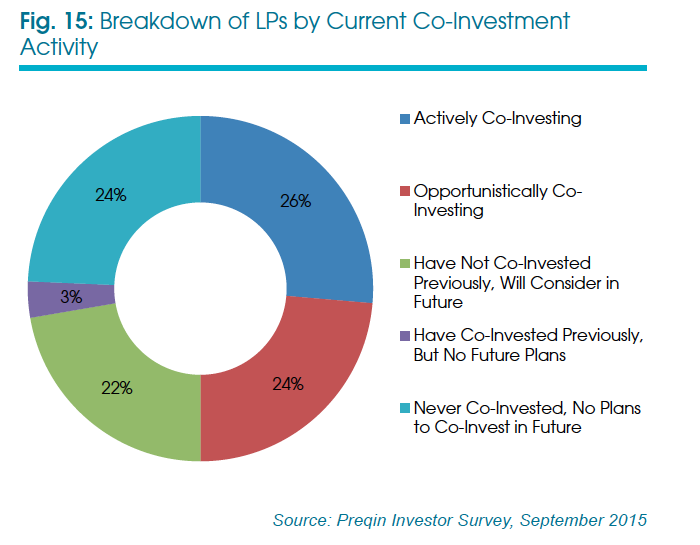

None of these findings have slowed the co-investing bandwagon. In a recent survey of 222 LPs, Preqin found that roughly three-quarters are, or are considering, co-investing alongside GPs.

Nearly 70 percent of those surveyed believed that co-investing could lead to higher returns than standard private equity fund investments.

As the PE industry and the practice of co-investing continue to mature, it may be that sophisticated institutional investors will win in the long-term. But given co-investing’s performance history and the long-established investing tradition of following the herd, LPs might be better off living with the chronic illness of high fees than taking medicine that may well make them sicker.

Josh Lerner questions the benefits for LPs who undertake co-investing to boost their returns.