Is Now the Time to Invest in Ag Tech?

A look at a market that some GPs claim is overlooked by private equity, which means greater opportunity for those already investing.

Despite the growing global population and demand for food, agriculture is still an under-represented sector in private equity, but several specialist firms are pursuing agricultural technology as a source of outsized returns.

The thesis: ag tech will be the primary means to sustainably increase food production to meet the ever-growing demand.

Privcap spoke to two PE players actively providing growth capital to the ag tech sector—New York-based Paine & Partners and California- and Israel-based Pontifax Global Food and Agriculture Technology Fund—about opportunities they’re excited about and why they find value in a sector so many others in private equity ignore.

An Untapped Market?

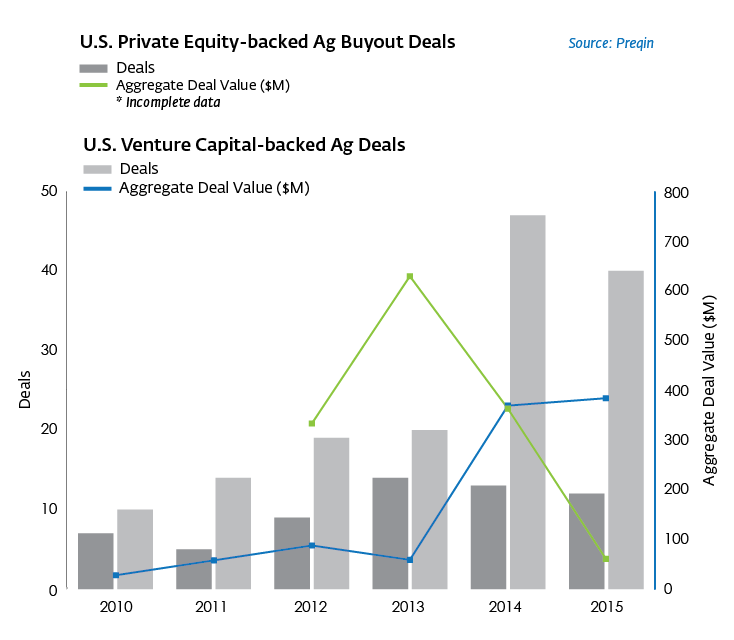

Historically, venture capital has been far more active in agriculture than private equity. According to data provider Preqin, PE buyout deals in the space fluctuated between 2010 and 2015, peaking in 2013 at $630M with 14 deals and falling to $363M in 13 deals in 2014. The number in 2015 was even lower. Comparatively, VC deals for agriculture increased more than tenfold, from $27M in 10 deals in 2010 to $384M in 40 deals in 2015.

“We’ve long believed that the agribusiness industry is underserved by PE,” says Kevin Schwartz, president and founding partner of Paine & Partners—an active agriculture investor for more than 15 years, having closed its fourth and most recent food and agribusiness fund, at $893M, in 2014.

He says the food industry’s strong fundamentals and macro factors like a booming population and an increasing focus on good nutrition present a great opportunity, but access to land and water are a long-term challenge. “There’s a need to increase productivity in the value chain,” he says.

Ben Belldegrun, a managing partner at Pontifax Global Food and Agriculture Technology Fund (known as Pontifax AgTech), puts it simply: the theme in agriculture investing is “doing more with less.”

Where to Find the Best Opportunities

Pontifax AgTech and Paine & Partners both operate in the space between venture capital seed stage and late stage‑proven technologies that have yet to be commercialized. Belldegrun says there’s very limited competition and, as a result, terms and valuations are reasonable, and the scarcity of capital relative to good opportunities means that co-investment opportunities abound.

Both firms stressed that success depends on having strong connection with farmers, which allows the investors to understand the market’s needs and wants. “The current operating environment focuses farmers on what really makes a different to the bottom line,” says Belldegrun.

The value proposition of new approaches is critical, as farmers have many options when it comes to things such as seed technology—which Paine & Partners invests in—and limited money, he explains. Another piece of the puzzle to consider is whether a retailer will want to sell a particular product, such as a brand of seed. “If the retailer doesn’t want to sell it, the farmer isn’t going to grow it,” Schwartz says.

Pontifax AgTech focuses on investments in the U.S. and Israel, ag tech’s global centers. The fund’s portfolio runs the gamut, and includes companies focused on software, bio-based synthetic oils, and technologies used to provide an alternative to traditional chemical and labor-intensive crop-cultivation strategies.

The firm is particularly interested in precision farming and technology that streamlines the post-harvest supply chain. “Forty to 60 percent of all produce never makes its way to the table,” says Philip Erlanger, the other managing partner at Pontifax AgTech. “We’re spending a lot of time on the supply chain, from processing to food packaging. It’s a primitive and fragmented industry, at a global level; there’s still a relative lack of infrastructure to take something from the field to get it to the customer.”

Emerging Technologies to Watch For

Other areas of ag tech that Erlanger and Belldegrun are excited about: waste management (including turning municipal solid waste into fertilizer); aquaculture (“Fish protein is a really compelling sector, with enormous long-term growth potential” says Erlanger); and gene editing (“There are opportunities to solve problems [using this] in human health, and you’re seeing those focuses starting to go into agriculture. It’s a means to addressing the GMO issue,” says Belldegrun).

“There will be increasing pressure, led by consumers and regulation, about the health and nutrition of agricultural produce and the crop inputs and chemicals that are utilized in production,” Erlanger says. “This, in turn, will drive a massive need for food traceability, data, and documentation. There are so many areas that are exciting.”

A look at a market that some GPs claim is overlooked by private equity, which means greater opportunity for those already investing.