In Fundraising Scramble, Why U.S. is ‘Belle of the Ball’

Europe-focused PE funds are having a comparatively hard time raising capital, experts say

Private equity fundraising is holding steady, but the lion’s share of capital is being raised by established firms in the U.S., two experts tell Privcap.

The observation is one of several themes in Privcap’s recently convened conversation between Alan Pardee of Mercury Capital Advisors and Chris Elvin of Preqin.

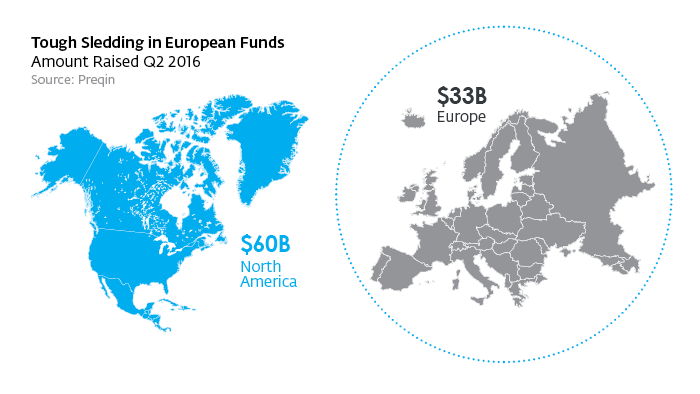

Elvin notes Preqin statistics showing that whereas $60B was raised for North American private equity funds in the second quarter of 2016, only $33B was raised for funds targeting Europe. Of special note is that the $33B figure includes a secondaries fund from Ardian that raised $10B, indicating that “regular way” private equity funds targeting Europe were well behind their U.S. counterparts.

Asked why U.S. private equity is the “belle of the ball,” Pardee says: “The North American funds are doing well today because people believe in what’s happening here in the U.S., and, to a degree, in Canada, in terms of the growth that’s still happening. We are the one economy at the moment that feels like it’s healthy and doesn’t have extreme risks.”

You can watch the full program, Fundraising Roundup, here: https://www.privcapdemo.com/fundraising-roundup-q2-2016-video/