From the CFO’s Office: Catching Up With Gerry Esposito, Newbury Partners

Download the article here

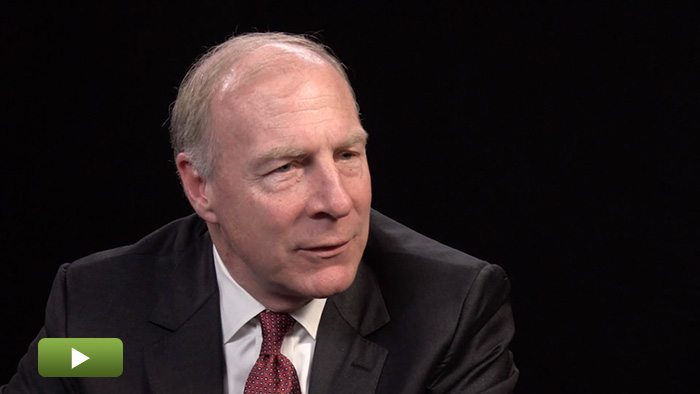

Gerry Esposito is a managing director and has served as the chief financial officer and chief compliance officer of Newbury Partners for 11 years. Newbury, based in Stamford, Conn., invests in buyout, venture capital, special situations, mezzanine, and fund-of-funds in the secondary markets, and has approximately $3 billion in assets under management

Privcap: What are a private equity CFO’s main concerns for their firm in the current market?

Gerry Esposito, Newbury Partners: At a high level, the concern is the ability of a firm to fundraise and generate results for investors while the industry is undergoing a recalibration of investment returns across the asset clawWss. That’s happening worldwide. How you manage and recalibrate in a declining return environment should be front and center for most private equity CFOs.

How have the CFO’s responsibilities evolved and expanded over time? What was the most challenging aspect of these changes for you?

Esposito: What’s been happening is that it’s getting more and more complicated to be a private equity firm in general, whether you’re involved in buyouts or the secondary market. There’s more regulatory pressure, and more investor demands. For at least the last seven or so years, there’s been a kind of job creep in the role. CFOs are uniquely positioned to be involved in every aspect of the firm – most CFOs are fixers, and there’s lots of fixing to be done.

The only way to cure a lot of this is rearranging your workflow, which I’m trying to do and which can be hard. The best results come from empowering your lieutenants to make decisions, so that a lot of the more basic stuff never makes it to your desk.

What trends in regulation and compliance are you watching most closely? Are there governmental or macroeconomic concerns that have recently become more prominent?

Esposito: I believe a lot of what’s been going on in private equity since 2010 has been political. We have been an easy target as an industry, and more and more regulators are jumping on the bandwagon, making more rules and regulations that weren’t previously applicable to private equity now applicable to private equity. The FinCEN (Financial Crimes Enforcement Network) “know your client” rule isn’t finalized, for example, but that’s part of the rules and regulations that need CFO-level attention.

Since the election, I don’t think there’ll be a wholesale furlough or release from regulations that have been passed in the last 10 years, but there will be more of a common-sense, businessman’s approach from regulators. If you’ve taken steps and used your reasonable judgement, I think regulators may have a more reasonable response to issues.

What do private equity CFOs talk about when they get together?

Well, I’m always impressed by the level of camaraderie among private equity CFOs, even among competitors. There aren’t that many of us, and it’s useful to have a handful of people whom you really trust to bounce ideas off of. CFOs should take advantage of that. You can’t do it from behind your desk. You have to get out there and meet people.

The Managing Director and CFO of Newbury Partners discusses the current challenges and strategies for CFOs in the current market.