How Smaller Funds Beat the Big Boys

A new finding from research done by Adveq and the London Business School goes against what some PE investors might have assumed

It’s obvious why smaller private equity-backed companies typically have higher growth rates than larger ones, but what about when the fund doing the investing is small, too?

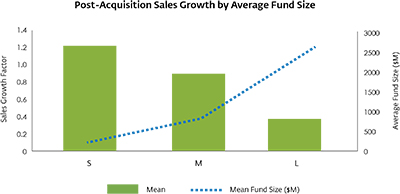

A recent study from the London Business School and global private equity firm Adveq found that private equity firms investing from relatively small funds generate the most significant post-buyout sales growth. Specifically, funds of less than $500M saw post-acquisition sales growth in their portfolio companies of about three times that of funds with more than $2.5B in capital.

“That’s a new and quite surprising finding,” Sven Liden, managing director and CEO at Adveq, says of the study, which was based on data from Preqin and other providers.

“As an investor, I wouldn’t have thought that growth at the smaller end of the market is larger. It’s proof that [portfolio] operations is the key.”

Why do smaller funds perform better? Liden says it’s more likely that those investments will be in family-owned companies with high growth potential, and done with the intention to foster that growth by expanding to another market or to another European country, says Liden.

Among the other findings highlighted in the report:

- – The valuation discounts of PE-initiated deals are present both before and after the credit crisis. In contrast, during the credit crisis, virtually no difference in valuation multiples between PE-initiated buyouts and other corporate acquisitions was observed.

- – GPs with good prior fund performance are able to improve portfolio companies’ operations more, relative to the GPs whose funds did not perform as well, thus providing some evidence that the implementation of growth strategies at the portfolio company level may lead to persistence in funds’ outperformance.

- – Established GPs (those that manage 10 funds or more) achieve significantly higher EBITDA and asset growth than the less-established GPs. They also make larger investments that are funded partly with leverage. This evidence indicates that GPs with more funds under management have developed deeper knowledge on the operational side. In contrast, newly established GPs with fewer funds under management appear to focus on sales growth.

A new finding from research done by Adveq and the London Business School goes against what some PE investors might have assumed.