Hot New Hidden Value: Customers

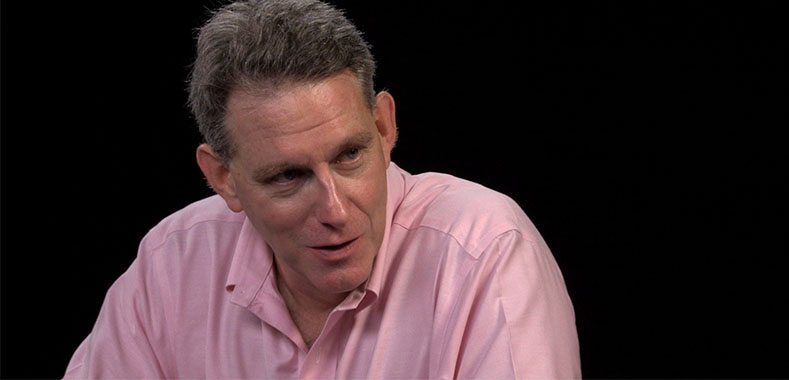

A pioneering professor of marketing at Wharton explains why private equity firms are keenly following his research into the prediction of consumer behavior

With the private equity deal market more competitive than ever, firms are trying their hardest to justify the rich prices they are paying to win auctions. In the consumer space, many are keenly following an evolving methodology that uncovers the often hidden value of customers.

Wharton School’s Prof. Peter Fader says in a recent interview with Privcap that, while every company is different, in many cases the lifetime value of customers is underpriced by the companies that sell the them. When it comes to consumer-facing companies that have non-contractual relationships with their customers (therefore making the customer spend harder to predict), “we find that companies tend to be undervaluing those customer assets, or therefore, the overall value of the company,” says Fader.

Fader confirms that a number of private equity firms who invest in the consumer space are fans: “There’s been a number of PE firms that have been watching my work in a way that’s – well, one might say creepy, but I’d say, really, it’s wonderful. It’s terrific.”

Watch the full interview with Peter Fader here

Fader’s work starts with an analysis of customer data broken down into recency, frequency and monetary value of purchasing. He says a superior big-data analysis of a company’s customers can produce a superior valuation for the company over traditional methods.

Fader says his advocacy of the use of big data in consumer and retail companies has met the most resistance from more traditionally-minded consumer and retail executives, who tend to broadcast the value of a founder’s gut instincts and product integrity. In this clip, Fader describes the data-aversion that “retailers” exhibit:

Prof. Peter Fader will present some of his findings at the upcoming Privcap Game Change: Consumer & Retail 2016 event. Learn more here