Is Africa’s PE Fundraising Frenzy Sustainable?

PE funds raised record amounts for African investment last year, as investors seek to cash in on the continent’s emerging middle class. The question is whether there’s enough opportunity to go around.

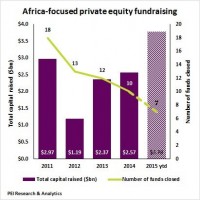

Private equity fundraising in Africa had a record year in 2015, with a total of $3.89B raised. That’s 51 percent higher than the 2014 total of $2.57B, according to data compiled by Private Equity International. But, despite the influx of capital, is it too much money chasing too few good deals?

Africa’s middle class is growing quickly, according to the AFK Insider, which is changing how private equity is allocating its investments. In the past, investments in Africa typically targeted its abundance of natural resources, in sectors such as mining and exploration. Now, investments are targeting telecommunications, infrastructure, consumer goods, and financial services.

In May, Privcap spoke with Idris Mohammed, a partner at Development Partners International about PE’s opportunity in Africa. DPI has benefited from increasing investor appetite—in April of 2015, the firm closed its second Africa-focused fund at $725M, above its $500M target. The firm’s first fund is now fully invested in nine companies, and it is currently targeting the services sector, in areas such as healthcare and education.

Mohamed Wann, a vice president at The Carlyle Group, told Privcap that as wealth accumulates in the sub-Saharan Africa region, so do the needs for more advanced financial services and improved infrastructure. The Carlyle Group launched an Africa-focused fund in 2011, called The Carlyle Sub-Saharan Africa Fund, which closed with $700M of capital by 2014.

But, despite the high fundraising numbers, it’s a challenging market.

Too many funds in sub-Saharan Africa are targeting a very small number of companies that may not be capable of absorbing the amount of capital coming in, according to research by the Overseas Development Institute. The companies are either too small, lack human capital, or are within underdeveloped sectors. And PE firms in the region have in excess of $4B in dry powder, which is driving prices higher.

Judith Tyson of ODI says that new policies are essential in order to create more investible companies rather than more investment funds; this would help prevent a bubble in Africa. Otherwise, despite successful fundraising, the promise of African PE could fall well short of its potential.

Private equity funds in Africa raised a record amount of capital in 2015—51 percent more than the previous year. This is largely due to its growing middle class and the increasing need for more resources.