PE Energy Fundraising Remains Resilient

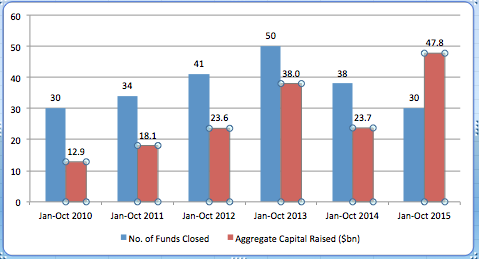

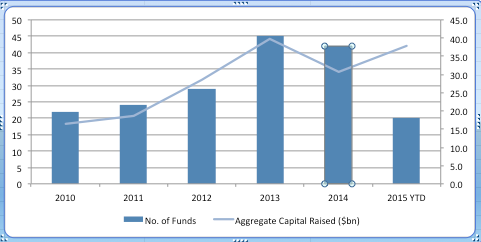

As of the end of October, there were 30 global energy-focused private equity funds closed. While that is down from the 50 funds closed in the boom year of 2013, the amount of capital raised so far in 2015 that’s been earmarked for energy beats each of the past five years.

With all of the chatter—and doom and gloom—about oil prices and the impact on private equity investments, it would make sense that the asset class would back off from raising energy-focused funds. But based on data from Preqin, that’s not necessarily the case.

From the beginning of January through October of this year there were 30 global energy funds closed, totaling $47.8B of aggregate capital raised and 20 North American energy funds closed with $37.8B of capital. The global total is a sharp increase from the same period of 2014, in which 38 funds were closed, but totaled only $23.7B, while in North America there were 42 funds closed, totaling $30.6B; in the boom year of 2013 there were 50 energy funds closed globally, totaling $38B, and North America saw 45 funds close for the same time period, at $39.7B.

According to Preqin, there are also 121 energy funds currently in the market, targeting an aggregate $64B of capital. Preqin’s data on energy-focused funds includes both upstream and downstream focuses in oil and gas, coal, uranium, and renewables.

In short: Firms are still raising and closing funds—or at least they were in the first half of 2015. And, in fact, most people in the private equity energy fundraising business are optimistic. They know that this is a cycle, and, as many are veterans of previous periods of oil price volatility, they know that opportunities are available if the right strategy is in place.

Kelly DePonte, the managing director at Probitas Partners, who is also responsible for the firm’s research, says the trend of 2015 energy fundraising has centered on distressed opportunities. “The bet in 2015 was that things could be bought cheaply, and that did not come to fruition,” he says.

There were many funds in the market at the beginning of 2015, with a lot of general partners of the mindset that they would buy some of these distressed assets. But because of the underlying environment, says DePonte, a lot of the sellers were reluctant to part with assets. And then the same GPs who were excited about buying opportunities in January of 2015 pushed that forward to January of 2016.

Managers with energy-focused funds in the market, or thought to be coming to market in the next 12 months, include Kayne Anderson Capital Advisors, currently at $1.6B of capital; Lime Rock Partners, currently at $1B; Denham Capital Management, with a current fund size of $2.5B; and the Carlyle Group at $1.5B, according to a Probitas report on developed-market PE funds.

There are also a few managers of private energy debt funds in the market through September 2015, according to a separate Probitas report, including PetroCap, targeting $300M in its second fund; Riverstone Holdings, targeting $1B; and EIG Global Energy Partners, also targeting $1B.

According to Preqin, fundraising for global private energy debt funds—a significant factor in 2013’s private debt fund total—dwindled significantly as oil prices collapsed. As of June 2015, there wasn’t even enough capital being raised in energy debt funds in the market to register in a bar chart.

Another piece of the puzzle is in the dynamics of putting all of the capital to work that’s been—or is currently being—raised. DePonte says that with the amount of PE dry powder waiting to be put to work that’s already targeted at energy, LPs will likely be reluctant in the near term to commit more.

“Many investors have placed energy bets on certain managers during the recent turmoil,” says DePonte. “Many of them are waiting to see how that capital is deployed before committing more.”

As of the end of October, there were 30 global energy-focused private equity funds closed. While that is down from the 50 funds closed in the boom year of 2013, the amount of capital raised so far in 2015 that’s been earmarked for energy beats each of the past five years.