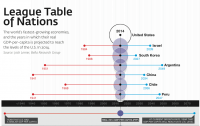

League Table of Nations

Within the lifetime of most investors, key emerging markets will reach the same GDP-per-capita that the U.S. enjoys today, according to new research from Harvard Business School Professor Josh Lerner.  In a relatively short amount of time, many key emerging markets will reach the level of wealth currently enjoyed by the U.S., according to new research findings from Harvard Business School’s Josh Lerner. While different emerging markets are growing at different rates, the coming decades will bear witness to significant growth among developing economies, Lerner says in a recent Privcap interview. “The striking thing is that when we look forward—not necessarily [to] tomorrow or the year after, but in the years and decades afterwards—given the historical trends that we’re seeing, we’re going to see some very dramatic accretion of wealth in these places,” says Lerner.

In a relatively short amount of time, many key emerging markets will reach the level of wealth currently enjoyed by the U.S., according to new research findings from Harvard Business School’s Josh Lerner. While different emerging markets are growing at different rates, the coming decades will bear witness to significant growth among developing economies, Lerner says in a recent Privcap interview. “The striking thing is that when we look forward—not necessarily [to] tomorrow or the year after, but in the years and decades afterwards—given the historical trends that we’re seeing, we’re going to see some very dramatic accretion of wealth in these places,” says Lerner.

Within the lifetime of most investors, key emerging markets will reach the same GDP-per-capita that the U.S. enjoys today, according to new research from Harvard Business School Professor Josh Lerner