Blue Wolf Capital Partners

We believe our core values allow us to achieve superior returns for our investors and sustainable profitability for our portfolio companies. Although we often invest in companies which have experienced distress, we strive to create businesses which generate value and have a long-term, impact on society through sustainable growth, innovation, meaningful employment, and environmental responsibility.

Featured Experts

Videos

-

Meeting an Environmental Challenge

How Blue Wolf Capital Partners executed on a plan of sustainable value creation for Northern Pulp.

May 4, 2018More -

A Brooklyn Clinic Changes the Healthcare Game

How Blue Wolf Capital Partners executed on a plan of sustainable value creation for ModernMD.

April 9, 2018More -

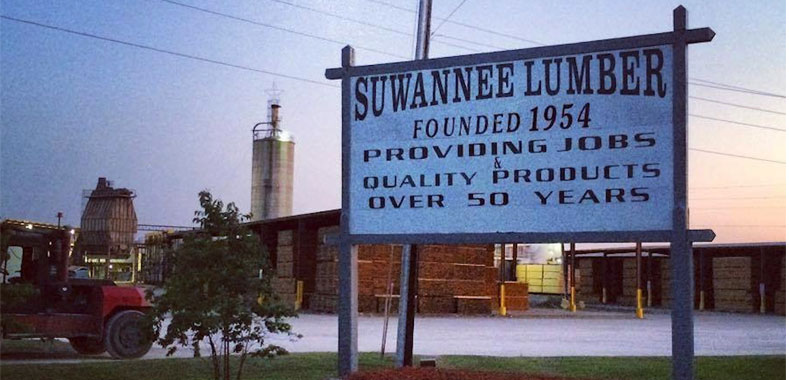

Adding Value to a Florida Timber Mill

How Blue Wolf Capital Partners executed on a plan of sustainable value creation for Suwannee Forest Products.

April 9, 2018More -

A Forest Products Company Grows Tall

How Blue Wolf Capital Partners executed on a plan of sustainable value creation for Caddo River Forest Products.

April 9, 2018More -

How technology is lowering the costs of diabetes

Smart phones are enabling pre-emptive care and lowering the costs of many diseases.

November 10, 2017More -

Marketing to patients can lower costs

Marketing healthcare services is more about controlling costs than promoting services.

October 27, 2017More -

Lower costs, improve outcomes

Why private equity is focused on home care and urgent care clinics.

October 16, 2017More -

A CFO Task Force Seeks Guidelines

Three private equity CFOs discuss gray areas in compliance pertaining to LP co-investment and portfolio company valuation.

April 20, 2015More -

Seeking Clear Website Content Rules

Three CFOs discuss the challenge of not knowing exactly what can be posted on a private equity firm’s website.

April 20, 2015More -

Fees, Expenses and Broker-Dealer Dangers

How much disclosure do PE firms need to offer surrounding fees, expenses and operating partners?

April 20, 2015More -

The Healthcare Private Equity Opportunity

Learn how private equity firms are partnering with healthcare innovators to build value in a rapidly changing market.

February 26, 2015More -

How Much Does a Fundraising Cost?

Dollars and sense in fundraising. Three PE leaders discuss how much money and time it takes to form a fund.

March 26, 2014More -

The Realities of Raising Capital

The Nitty Gritty of Fundraising: A candid discussion about what is involved in a forming a fund.

February 18, 2014More -

Carve-Outs: Plan of Action

How plans of action are devised and executed in private equity carve-out deals.

February 3, 2014More -

Fundraising in the Shadow of the Financial Crisis

Three PE fundraising experts discuss how they raise funds in the post-financial crisis era.

January 28, 2014More -

Happy Management, Happy Carve-Out

How private equity investors align division management with corporate carve-out investment objectives.

December 2, 2013More -

Carving, Then Thriving

How do private equity GPs identify attractive corporate carve-out opportunities?

October 29, 2013More

Reports

-

CFO Conversations: Complexity Forces CFOs to Stretch

How can “traditional” private equity CFOs navigate an increasingly challenging regulatory and tax landscape?

October 1, 2018More -

The Consumerization of Healthcare

A complimentary report on private equity opportunities in a rapidly changing market.

January 5, 2018More -

Five Compliance Areas in Need of Clarity

Three mid-market CFOs discuss partnering with the ACG to compile best practices in order to stay in step with SEC regulations.

April 20, 2015More -

Investing in U.S. Healthcare

An executive summary of the Privcap webinar: “The Healthcare Private Equity Opportunity”

March 30, 2015More -

Fundraising in Focus

An executive summary of the Privcap series Private Equity Fundraising.

April 23, 2014More -

The Craft of the Carve-Out

An executive summary of the Privcap series Carve-Outs: The Art & Science of Dealmaking.

February 3, 2014More